Wall Street’s stock indexes jumped on Friday, with the benchmark S&P 500 index nearing a record high, after Federal Reserve Chair Jerome Powell said “the time has come” to reduce interest rates.

At a highly anticipated annual economic conference in Jackson Hole, Powell endorsed imminent policy easing citing risks in the job market and inflation coming within reach of the Fed’s 2% target.

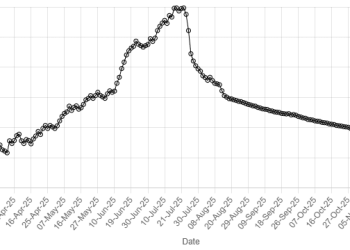

The S&P 500 extended early gains and was less than 1% away from surpassing a record high clinched in July, after falling as much as 9.7% from that level earlier this month.

Megacap growth names such as Meta and Amazon.com climbed 1% each, boosting the index, while chip stocks such as Nvidia and Broadcom rose more than 3% each.

At 10:05 a.m. the Dow Jones Industrial Average rose 302.68 points, or 0.74%, to 41,015.46, the S&P 500 gained 56.13 points, or 1.01%, to 5,626.77 and the Nasdaq Composite gained 255.03 points, or 1.45%, to 17,874.38.

The three indexes were on track for their second straight week of gains, with the S&P 500 poised for an over 1% rise.

All S&P 500 sectors advanced, led by a 1.4% rise in technology stocks, while the Philadelphia chip index advanced 2.2%.

Wall Street slips as yields perk up

Meanwhile, Atlanta Fed President Raphael Bostic said the Fed is on the cusp of being in a position to start lowering its benchmark interest rate, according to a report.

The Fed is scheduled to meet on Sept. 17 and 18, with traders pricing in a 71.5% chance that the central bank will cut borrowing costs by 25 basis points, according to CME Group’s FedWatch tool.

“The market has been predicting the first rate cut to start going back to March of this year and investors have been disappointed multiple times,” said Sam Stovall, chief investment strategist at CFRA Research in New York.

“The only question is by how much and, unlike the sprinters in the Olympics, the Fed will not explode out of the blocks with a 50-basis-point cut.”

Minutes from the Fed’s July meeting this week showed a number of policymakers were ready to consider rate cuts come September, while recent economic data signaled the U.S. economy was slowing, albeit gradually, assuaging fears over a sharp downturn.

That has helped Wall Street’s three main indexes recover from a plunge earlier this month triggered by a dour July employment report and yen carry trade.

Among other movers on Friday, Workday shares jumped 11.2% after the human resource software provider beat market expectations for second-quarter revenue and announced a $1 billion stock buyback plan.

Cruise will offer its autonomous vehicles on ride-hailing platform Uber starting next year, the companies said, as the General Motors-backed robotaxi firm attempts a comeback, sending shares of the automaker up 2.2%.

Ross Stores gained 3.8% after the discount retailer raised its fiscal 2024 profit forecast.

Advancing issues outnumbered decliners by a 9.02-to-1 ratio on the NYSE and by a 3.95-to-1 ratio on the Nasdaq.

The S&P 500 posted 52 new 52-week highs and no new lows, while the Nasdaq Composite recorded 57 new highs and 25 new lows.