JAKARTA: Malaysian palm oil futures extended losses to a fourth straight session on Thursday, tracking rival oils contracts at the Dalian market and a stronger ringgit.

Malaysian palm oil lower

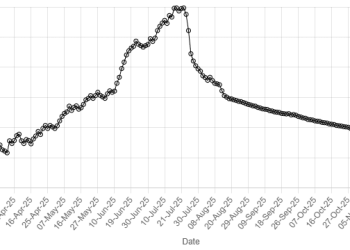

The benchmark palm oil contract for November delivery on the Bursa Malaysia Derivatives Exchange was down 28 ringgit, or 0.72%, at 3,858 ringgit ($890.58) a metric ton, as of 0231 GMT.

Fundamentals

Dalian’s most-active soyoil contract fell 0.8%, while its palm oil contract was down 0.81%. The Chicago Board of Trade gained 0.1%.

Palm oil tracks price movements in related oils as they compete for a share in the global vegetable oils market.

The Malaysian ringgit, palm’s currency of trade, gained 0.48% against the dollar. A stronger ringgit makes palm oil less attractive for foreign currency holders.

Malaysia’s palm oil inventories are expected to have climbed to their highest levels in six months at the end of August due to lacklustre export demand, a Reuters survey showed.

Indonesia, the world’s biggest palm oil exporter, plans to lower export levy rates of the tropical oil to improve competitiveness against rival vegetable oils and raise farmers’ income.

Malaysia’s August palm oil exports are seen at 1,376,412 metric tons, according to Amspec Agri.

Exports of Malaysian palm oil products for August fell 9.9% to 1,445,442 tons from 1,604,578 tons shipped during July, cargo surveyor Intertek Testing Services said.

Oil was attempting to hold its line in early trade on Thursday after an overnight sell-off, as players grappled with weak demand alongside a possible delay to more supply entering the market next month.

Stronger crude oil futures make palm a more attractive option for biodiesel feedstock.

Palm oil may break support at 3,864 ringgit per metric ton, and fall into the 3,777 ringgit to 3,821 ringgit range, according to Reuters’ technical analyst Wang Tao.