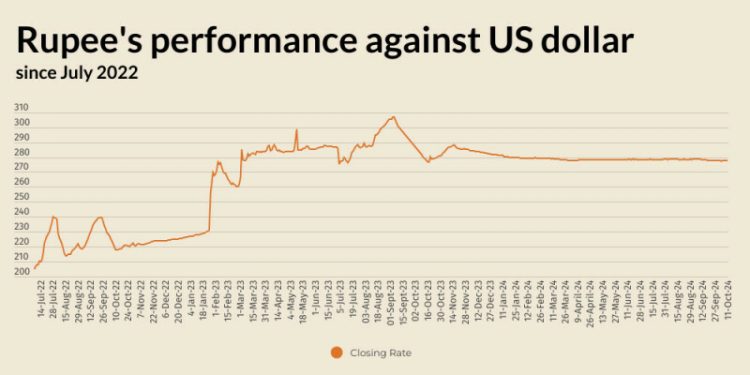

The Pakistani rupee ended marginally stronger against the US dollar, appreciating 0.05% in the inter-bank market on Friday.

At close, the currency settled at 277.64, a gain of Re0.15 against the greenback.

On Thursday, the rupee had settled at 277.79, according to the State Bank of Pakistan (SBP).

Globally, the US dollar fell from two-month highs hit overnight versus its major peers after signs of weakness in the labour market boosted the case for quicker Federal Reserve rate cuts.

Despite that, the US dollar on Friday remained on track for a second straight weekly advance after surprisingly strong monthly payrolls figures last week prompted traders to take bets for a half-percentage-point cut at the Fed’s next policy meeting off the table.

The market’s interpretation of Thursday’s surge in initial jobless claims was complicated by an uptick in the consumer price index (CPI) the same day, which served as a reminder that restrictive monetary policy may be required to bring inflation under control.

The dollar index, which measures the currency against six peers, was flat at 102.84 as of 0111 GMT, but down 0.3% from 103.17 on Thursday which was its highest level since Aug. 15.

For the week, the index is on track for 0.39% advance, building on the previous week’s 2.06% surge.

Oil prices, a key currency indicator, retreated on Friday after settling higher the previous day, but prices remained set for a second weekly gain as investors weighed the impact of hurricane damage on US demand against any broad supply disruption if Israel attacks Iranian oil sites.

Brent crude oil futures fell 94 cents, or 1.2%, to $78.46 a barrel by 0650 GMT.

US West Texas Intermediate crude futures slipped 86 cents, or 1.1%, to $74.99 per barrel. For the week, both benchmarks were headed for gains.

Inter-bank market rates for dollar on Friday

BID Rs 277.64

OFFER Rs 277.84

Open-market movement

In the open market, the PKR declined 5 paise for buying and remained unchanged for selling against USD, closing at 278.15 and 279.59, respectively.

Against Euro, the PKR gained 45 paise for buying and 43 paise for selling, closing at 301.83 and 304.67, respectively.

Against UAE Dirham, the PKR gained 5 paise for both buying and selling, closing at 75.32 and 76.01, respectively.

Against Saudi Riyal, the PKR lost 1 paisa for buying and gained 1 paisa for selling, closing at 73.52 and 74.17, respectively.

Open-market rates for dollar on Wednesday

BID Rs 278.15

OFFER Rs 279.59