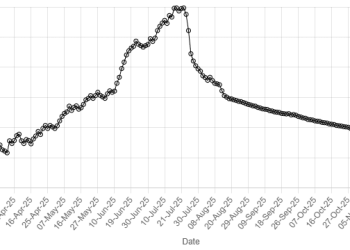

The Pakistani rupee recorded a marginal decline against the US dollar, depreciating 0.01% in the inter-bank market on Monday.

At close, the currency settled at 277.68, a loss of Re0.04 against the greenback.

During the previous week, rupee weakened marginally as it depreciated Re0.03 or 0.01% against the US dollar.

The local unit closed at 277.64 against 277.61 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar was pushing higher and on course for its largest monthly rise in 2-1/2 years as signs of strength in the US economy and bets on Donald Trump winning the presidency lifted US yields.

The US dollar index has climbed 3.6% to 104.49 during October, its sharpest monthly rise since April 2022.

The week ahead is crowded with data, with inflation readings for Europe and Australia, gross domestic product data in the US and purchasing managers’ indexes for China.

Weekend data showed China’s industrial profits plunged in September, with a year-on-year drop of 27.1%. The yuan hit its weakest since late August at 7.1355 per dollar.

Oil prices, a key indicator of currency parity, tumbled by more than $4 a barrel on Monday after Israel’s retaliatory strike against Iran at the weekend bypassed oil and nuclear facilities and did not disrupt energy supplies.

Both Brent and US West Texas Intermediate crude futures hit their lowest since October 01 at the open. By 0915 GMT Brent was down $4.12, or 5.4%, at $71.93 a barrel while WTI dropped $4.03, or 5.6%, to $67.75.

The benchmarks gained 4% last week in volatile trade as markets priced in uncertainty over the looming US election and the extent of Israel’s expected response to the Iranian missile attack.

Inter-bank market rates for dollar on Monday

BID Rs 277.68

OFFER Rs 277.88

Open-market movement

In the open market, the PKR gained 4 paise for buying and lost 1 paisa for selling against USD, closing at 276.71 and 278.63, respectively.

Against Euro, the PKR gained 24 paise for buying and 22 paise for selling, closing at 297.85 and 300.57, respectively.

Against UAE Dirham, the PKR remained unchanged for buying and lost 1 paisa for selling, closing at 75.22 and 75.92, respectively.

Against Saudi Riyal, the PKR remained unchanged for both buying and selling, closing at 73.46 and 74.10, respectively.

Open-market rates for dollar on Monday

BID Rs 276.71

OFFER Rs 278.63