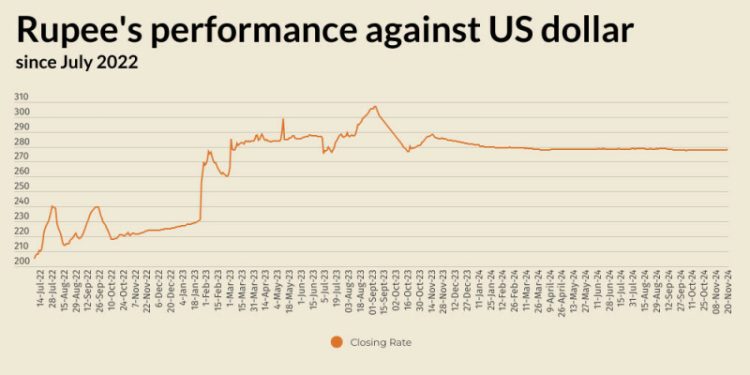

The Pakistani rupee recorded a marginal decline against the US dollar, depreciating 0.03% in the inter-bank market on Wednesday.

At close, the currency settled at 278.04, a loss of Re0.09 against the greenback.

On Tuesday, the rupee had settled at 277.95, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar slipped to a one-week low versus major peers on Wednesday, looking to extend a three-day decline from a one-week peak as the market catches its breath following the frantic rally in the wake of Donald Trump’s election.

A boost to the dollar and other traditional safe-haven currencies like the yen overnight proved short-lived, after Russia’s foreign minister said the country will “do everything possible” to avoid the onset of nuclear war, hours after Moscow announced it would lower its threshold for a nuclear strike.

Bitcoin pushed to a fresh all-time peak above $94,000, carried by expectations for a friendlier regulator environment for cryptocurrencies under Trump.

The dollar index – which measures the currency against six major peers, including the yen and euro – fell to a low of 106.07 for the first time since Wednesday of last week, and stood at 106.18 at 0247 GMT.

The index climbed to a one-year high of 107.07 on Thursday, buoyed by expectations for big fiscal spending, higher tariffs and tighter immigration under the incoming US administration, measures which economists say could foster inflation and potentially slow Federal Reserve easing.

Oil prices, a key indicator of currency parity, was broadly stable on Wednesday as concerns about escalating hostilities in the Ukraine war potentially disrupting oil supply from Russia offset data showing rising U.S. crude stocks.

Brent crude futures for January were up 22 cents, or 0.3%, to $73.53 a barrel at 1026 GMT.

US West Texas Intermediate crude futures for December, due to expire on Wednesday, were up 31 cents, or 0.5%, to $69.70, while the more active WTI contract for January was up 24 cents at $69.48.

The escalating war between major oil producer Russia and Ukraine has kept a floor under the market this week.

Inter-bank market rates for dollar on Wednesday

BID Rs 278.04

OFFER Rs 278.24

Open-market movement

In the open market, the PKR lost 9 paise for buying and 11 paise for selling against USD, closing at 277.13 and 278.99, respectively.

Against Euro, the PKR lost 35 paise for buying and 39 paise for selling, closing at 291.45 and 294.28, respectively.

Against UAE Dirham, the PKR lost 5 paise for buying and 7 paise for selling, closing at 75.32 and 76.04, respectively.

Against Saudi Riyal, the PKR lost 4 paise for buying and 8 paise for selling, closing at 73.56 and 74.24, respectively.

Open-market rates for dollar on Wednesday

BID Rs 277.13

OFFER Rs 278.99