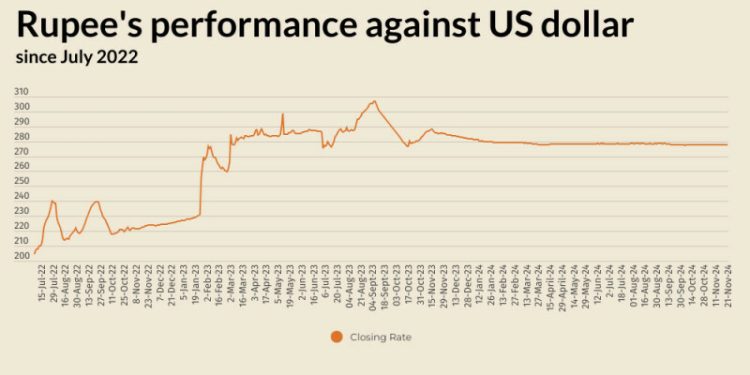

The Pakistani rupee recorded a marginal improvement against the US dollar, appreciating 0.03% in the inter-bank market on Thursday.

At close, the currency settled at 277.96, a gain of Re0.08 against the greenback.

On Wednesday, the rupee had settled at 278.04, according to the State Bank of Pakistan (SBP).

Globally, the US dollar stood broadly firm on Thursday as traders awaited more clarity on US President-elect Donald Trump’s proposed policies and sought to second-guess the prospects of less aggressive interest rate cuts from the Federal Reserve.

After stalling for three sessions, the greenback was back on the march higher, with investors lifting the dollar index measure against its key rivals closer to a one-year high of 107.07 hit last week.

The US dollar has rallied more than 2% since the Nov. 5 US presidential election on bets Trump’s policies could reignite inflation and temper the Fed’s future rate cuts.

At the same time, traders are sizing up what Trump’s campaign pledges of tariffs mean for the rest of the world, with Europe and China both likely on the firing line.

Elsewhere, bitcoin reached a record high of $95,016 on Wednesday, underpinned by a report Trump’s social media company was in talks to buy crypto trading firm Bakkt.

Bitcoin has been swept up in a blistering rally in the past few weeks in hopes the president-elect will create a friendlier regulatory environment for cryptocurrencies.

Oil prices, a key indicator of currency parity, rose on Thursday as Russia and Ukraine launched missiles at each other, overshadowing the impact of a bigger-than-expected increase in U.S. crude inventories.

Brent crude futures rose 96 cents, or 1.3%, to $73.77 as of 1017 GMT. U.S. West Texas Intermediate crude futures rose 99 cents, or 1.4%, to $69.74.

Prices had earlier risen by more than $1.