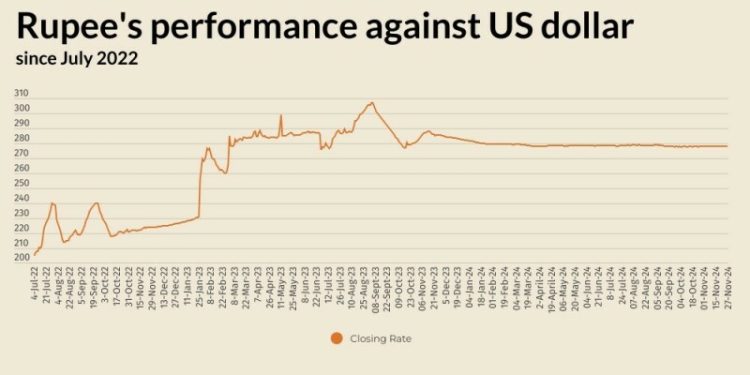

The Pakistani rupee recorded a marginal decline against the US dollar, depreciating 0.04% in the inter-bank market on Wednesday.

At close, the currency settled at 277.96, a loss of Re0.12 against the greenback.

On Tuesday, the rupee had settled at 277.84, according to the State Bank of Pakistan (SBP).

Globally, the US dollar steadied against major peers on Wednesday as investors continued to take stock of President-elect Donald Trump’s tariff pledges, while keeping an eye on a key inflation figure out of the US later in the day.

Trump’s vows on Monday of big tariffs on Canada, Mexico and China, the United States’ three largest trading partners, have left investors jittery, even if some of the reaction was tempered later in the US day.

The US dollar was last little changed versus its Canadian counterpart at C$1.4052, below Tuesday’s 4-1/2-year high of C$1.4178.

The US dollar remained off Tuesday peak against the Mexican peso, after touching its highest since July 2022 in the previous session.

The US dollar has experienced some turbulence in the past few sessions, falling on the back of Trump’s late Friday naming of hedge fund manager Scott Bessent to become US Treasury secretary, before surging after Trump’s tariff vows.

The US dollar index, which measures the greenback against six rivals, was last down 0.07% at 106.83.

Oil prices, a key indicator of currency parity, edged up on Wednesday, with markets assessing the potential impact of a ceasefire deal between Israel and Hezbollah and Sunday’s OPEC+ meeting, in which the group could delay a planned increase to oil output.

Brent crude futures rose 29 cents, or 0.4%, to $73.10 a barrel by 0750 GMT and US West Texas Intermediate crude was up 26 cents, or 0.4%, at $69.03.