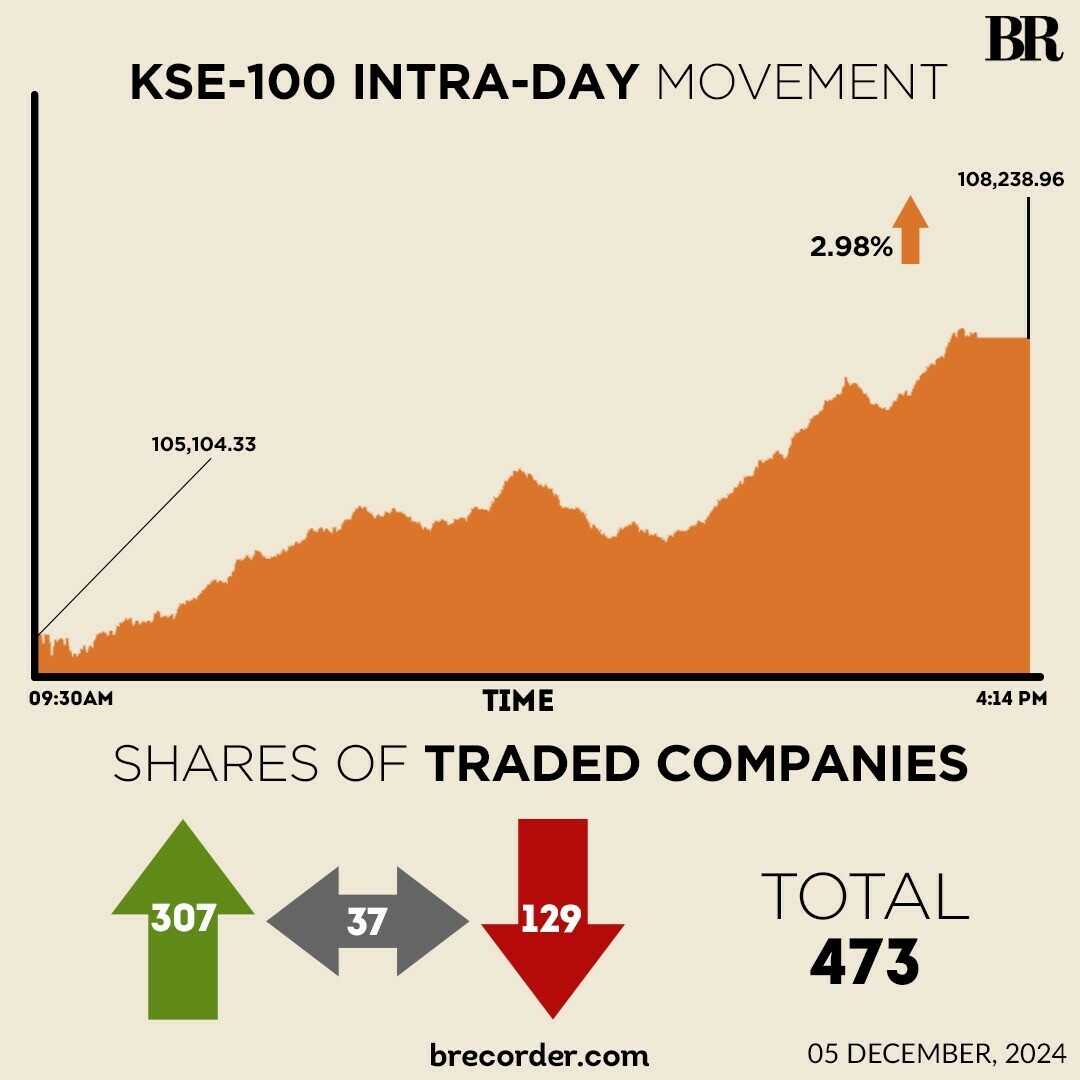

There was no stopping the KSE-100 on Thursday as a wider market buying spree propelled the benchmark index to settle above 108,000, a new record high, with a gain of over 3,000 points.

At close, the benchmark index settled at 108,238.96, an increase of 3,134.63 points or 2.98%.

It was a day that saw the KSE-100 gradually increase throughout the session as buying continued across the wider market. Interest was seen in key sectors including oil and gas exploration companies, OMCs, refinery, power generation, fertiliser and commercial banks. Index-heavy stocks including MARI, NRL, HUBCO, PSO, SNGPL, NBP, MEBL and MCB traded in the green.

“The PSX achieved another milestone as market activity surged to a 19-year high, with a traded value of Rs63.0 billion ($227 million),” said brokerage house Arif Habib Limited (AHL) in a note.

“This marks the highest activity in the regular market since 17-Apr-2006,” it added.

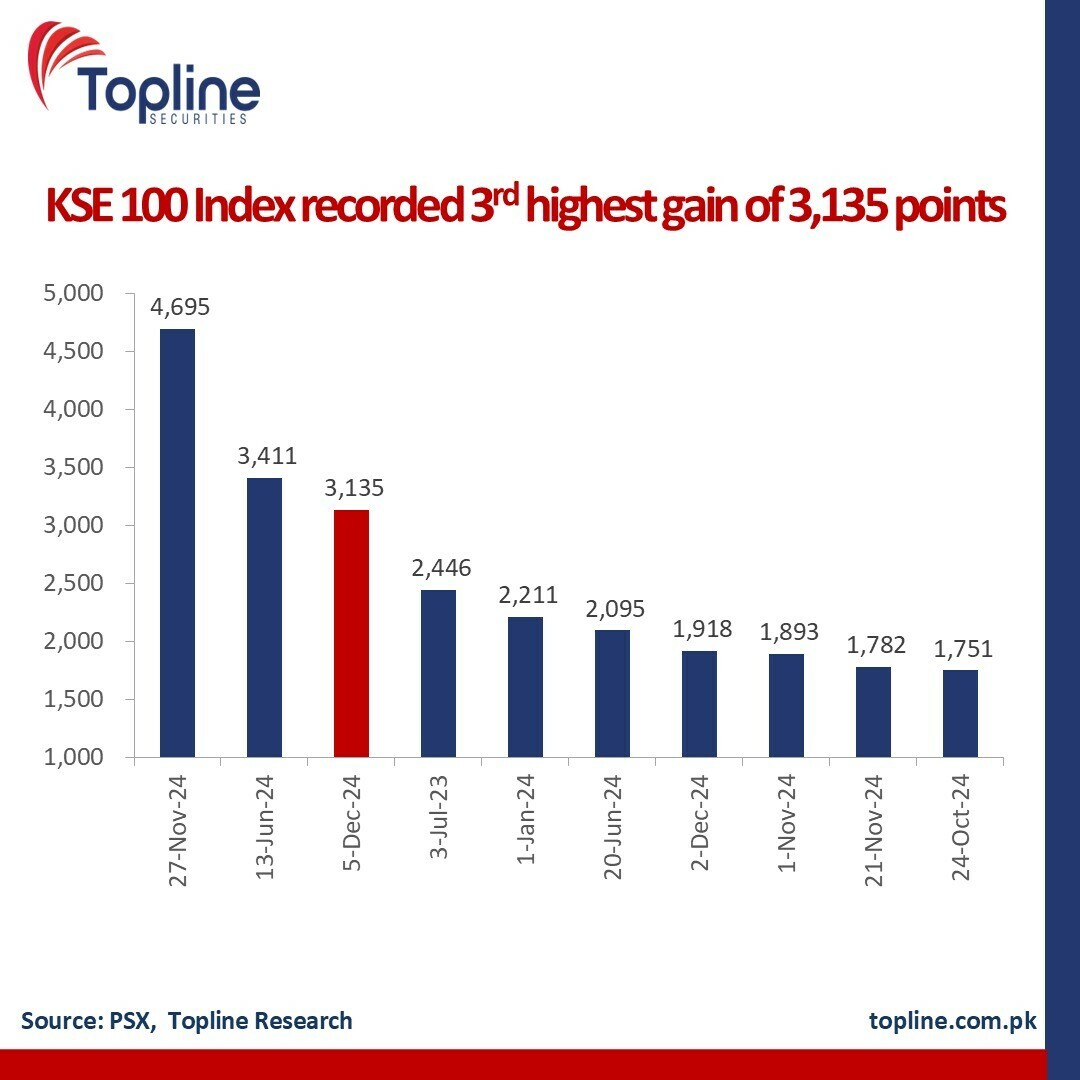

Topline Securities shared that this was the third-highest increase posted by the KSE-100 in terms of points.

Experts have credited the ongoing buying by local institutions, coupled with high trading volumes, to strong investor confidence, which is fuelled by expectations of a reduction in the key policy rate in the upcoming Monetary Policy Committee (MPC) meeting.

The MPC is scheduled to meet on December 16, 2024.

Topline Securities said Thursday’s rally was predominantly driven by “relentless buying” from local mutual funds, which acted as the primary catalyst for sustaining the bull run.

“Blue-chip stocks and high-capitalisation sectors spearheaded the advance, with major contributions from MARI, FFC, HUBC, UBL, PPL, and LUCK, collectively adding 1,303 points to the index’s stellar performance,” it said.

On Wednesday, PSX had maintained its bullish trend and hit new levels on the back of investors’ strong interest.

The benchmark index surged by 545.26 points and closed at its then-highest level of 105,104.34.

Internationally, Asian stocks face selling pressure from foreign investors for a second consecutive month in November amid worries over potential US tariff hikes on regional exports under the incoming Donald Trump administration next year.

Foreigners net withdrew $15.88 billion out of equity markets in Taiwan, South Korea, India, Thailand, Indonesia, Vietnam and the Philippines, following a net $15.38 billion worth of sales in the prior month, LSEG data showed. It was their largest monthly net selling since June 2022.

Last month, Trump pledged to impose significant tariffs on the United States’ three largest trading partners, including China, a move that could impact regional exports heavily reliant on strong supply chains with China.

Meanwhile, the Pakistani rupee remained largely stable against the US dollar, depreciating 0.01% in the inter-bank market on Thursday. At close, the currency settled at 277.94, a loss of Re0.02 against the greenback.

Volume on the all-share index decreased to 1,647.13 million from 1,749.32 million on Wednesday.

However, the value of shares rose to Rs63.23 billion from Rs50.42 billion in the previous session.

B.O.Punjab was the volume leader with 163.46 million shares, followed by WorldCall Telecom with 150.48 million shares, and Cnergyico PK with 86.66 million shares.

Shares of 473 companies were traded on Thursday, of which 307 registered an increase, 129 recorded a fall, while 37 remained unchanged.