A day after witnessing profit-taking, bullish momentum returned to the Pakistan Stock Exchange (PSX) with the benchmark KSE-100 Index gaining over 2,000 points during the early hours of trading on Wednesday.

At 10:35am, the benchmark index was hovering at 110,930.46, an increase of 2,033.81 or 1.87%.

Across-the-board buying was observed in key sectors including automobile assemblers, cement, commercial banks, fertilizer, oil and gas exploration companies, OMCs, refinery and power generation. Index-heavy stocks including HUBCO, PSO, SSGC, SHELL, ENGRO, MCB, MEBL, HBL and DGKC traded in green.

The buying spree was spurred by improved economic indicators, including a reduction in the inflation rate, which dropped to 4.9% in November. The decline in inflation has raised expectations of a further policy rate cut during the upcoming Monetary Policy Committee (MPC) meeting.

In a key development, a high-level meeting was held on Tuesday to address the issue of the Advance-to-Deposit Ratio (ADR) in the banking sector. The participants discussed the use of ADR policy on overall lending to productive sectors of the economy, its impact on tax revenue targets, and the optimum environment for the banking sector.

The government, vide Finance Act 2022, had introduced higher tax rates on investment income for banks with ADR ratio below 50%. This tax aims to increase commercial lending and tax passive income at higher rate being an income from non-exertion.

On Tuesday, PSX witnessed a highly volatile session, and after moving in both directions, closed in negative zone due to selling pressure as investors opted to book profit on available margins. The benchmark KSE-100 Index plunged by 1,073.74 points or 0.98% and closed at 108,896.65 points.

Asian stock markets and the dollar took a breather on Wednesday ahead of an anticipated rate cut in Canada and a U.S. inflation reading expected to leave the Fed on course to cut rates again.

Investors were a touch cautious because, with an 85% chance of a U.S. rate cut next week priced in and with Wall Street indexes around record highs, there is room for disappointment.

The S&P 500 had dipped 0.3% overnight though it was just 65 points, or a little short of 1% shy of its all-time high.

US futures were 0.1% higher in the Asia morning. MSCI’s broadest index of Asia-Pacific shares outside Japan was flat and Japan’s Nikkei fell 0.4%.

US Steel shares had dropped nearly 10% overnight on a Bloomberg News report suggesting Nippon Steel’s $15 billion takeover bid would be blocked.

This is an intra-day update

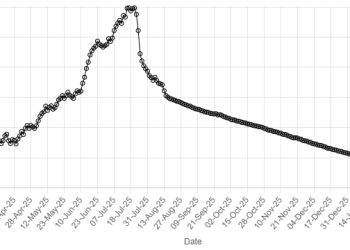

American Dollar Exchange Rate

American Dollar Exchange Rate