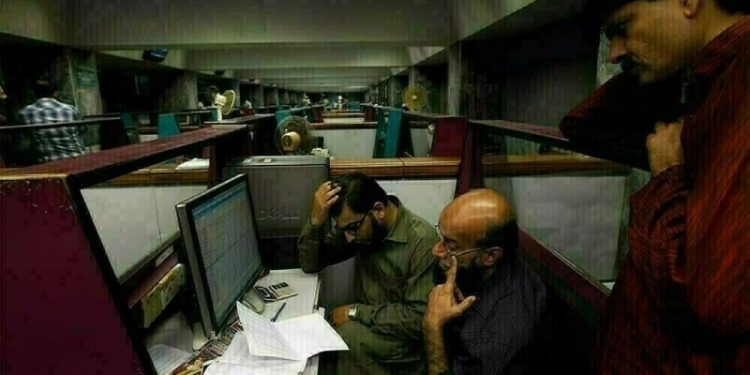

After profit-taking in the first half of the trading session, the Pakistan Stock Exchange (PSX) staged a comeback with the benchmark KSE-100 Index recovering all the intra-day losses to close in the green.

The KSE-100 started the session positive, hitting an intra-day of 115,172.45 for the first time, followed by a strong selling pressure that pushed the index into the negative territory, losing over 1,500 points.

However, the index fought off the sag on late-session buying and recovered the intra-day losses to close marginally higher as compared to the previous close.

The benchmark index settled on Friday at 114,301.80, up by 121.29 points or 0.11%

Earlier, selling was witnessed in key sectors including automobile assemblers, cement, commercial banks, oil and gas exploration companies, OMCs, power generation and refineries. Index-heavy stocks including NRL, PRL, HUBCO, PSO, SSGC, PPL, ENGRO, HBL, MCB, MEBL and NBP traded in the red.

“There is no letting up in the investor optimism, and we see no major risks on the politics or the economy fronts,” said Intermarket Securities Limited.

“Still we think that investors should book profits in stocks which have run up the strongest, mostly in the large-cap space,” it added.

On Friday, pressure was observed in the banking sector, where UBL, MEBL, BAHL, HBL, and BAFL cumulatively lost 860 points to weigh down on the index.

“Pressure can be attributed to noise that committee formed earlier this week to discuss alternative options to ADR-based tax regime has finalised recommendation,” Topline Securities said in a post-market report.

On Thursday, the stock market achieved another historic milestone and hit a record high with impressive gains and increased trading volumes on the back of strong interest of local investors.

The interest comes amid expectation of further interest rate cuts after declining inflation and improving macroeconomic indicators.

On a weekly basis, the KSE 100 Index gained 4.83%, making it eight consecutive positive closing as expectation of interest rate cut in the upcoming monetary policy meeting scheduled for December 16 kept the investor interest robust and continuous buying by mutual funds provided further stimulus to the market, Topline said.

Internationally, Asian shares fell on Friday as a strong dollar kept risk sentiment fragile, while longer-dated Treasury yields are heading for their biggest weekly rise this year as expectations for deep US rate cuts in 2025 recede.

A top-level meeting in Beijing pledged to increase debt and boost consumption but failed to boost Chinese equity markets.

Policymakers are girding for more trade tensions with the US as Donald Trump’s return to power approaches. It has been a week of rate cuts from Switzerland, Canada and the European Central Bank, which had rate differentials working in the favour of the US dollar.

The other main point of the week has been the rise in long-term treasury yields.

Markets are still confident of a cut from the Federal Reserve next week but suspect it will sound cautious about next year.

MSCI’s broadest index of Asia-Pacific shares outside Japan slipped 0.5% in Friday morning trade.

Meanwhile, the Pakistani rupee saw marginal improvement against the US dollar, appreciating 0.04% in the inter-bank market on Friday. At close, the currency settled at 278.12 for a gain of Re0.11 against the greenback.

Volume on the all-share index decreased to 1,118.57 million from 1,469.56 million on Thursday.

The value of shares also declined to Rs59.51 billion from Rs67.28 billion in the previous session.

WorldCall Telecom was the volume leader with 129.90 million shares, followed by Pak Int.Bulk with 75.51 million shares, and Treet Corp with 47.77 million shares.

Shares of 461 companies were traded on Friday, of which 178 registered an increase, 251 recorded a fall, while 32 remained unchanged.