SYDNEY: Asian shares edged lower on Monday as high Treasury yields challenged lofty Wall Street equity valuations while underpinning the U.S. dollar near multi-month peaks.

Volumes were light with the New Year holiday looming and a rather bare data diary this week. China has the PMI factory surveys out on Tuesday, while the U.S. ISM survey for December is due on Friday.

MSCI’s broadest index of Asia-Pacific shares outside Japan, dipped 0.2%, but is still 16% higher for the year. Japan’s Nikkei eased 0.2%, but is sitting on gains of 20% for 2024.

South Korea’s main index has not been so fortunate, having run into a storm of political uncertainty in recent weeks, and is saddled with losses of more than 9% for the year. It was last off 0.35%.

S&P 500 futures and Nasdaq futures were both off 0.1%. Wall Street suffered a broad-based sell off on Friday with no obvious trigger, though volumes were just two-thirds of the daily average.

The S&P 500 is still up 25% for the year and the Nasdaq 31%, which is stretching valuations when compared to the risk-free return of Treasuries.

Investors are counting on earnings per share growth of just over 10% in 2025, versus a 12.47% expected rise in 2024, according to LSEG data.

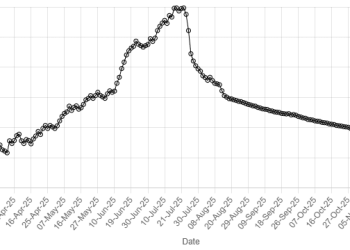

Yet yields on 10-year Treasuries are near eight-month highs at 4.631% and ending the year around 75 basis points above where they started it, even though the Fed delivered 100 basis points of cuts to cash rates.

“The continued rise in bond yields, driven by the reassessment of less restrictive monetary policy expectations, creates some concern,” said Quasar Elizundia, a research strategist at broker Pepperstone.

“The possibility that the Fed may keep restrictive monetary policy for longer than expected could temper corporate earnings growth expectations for 2025, which could in turn influence investment decisions.”

Bond investors may also be wary of burgeoning supply as President-elect Donald Trump is promising tax cuts with few concrete proposals for restraining the budget deficit.

Trump is expected to release at least 25 executive orders when he takes office on Jan. 20, covering a range of issues from immigration to energy and crypto policy.

Asia shares rise, dollar underpinned by elevated bond yields

Widening interest rate differentials have kept the U.S. dollar in demand, giving it gains of 6.5% for the year on a basket of major currencies .

The euro has lost more than 5% on the dollar so far in 2024 to last stand at $1.0429 , not far from its recent two-year trough of $1.0344.

The dollar held near a five-month top on the yen at 157.71 , with only the risk of Japanese intervention preventing another test of the 160.00 barrier.

The strength of the dollar has been something of a burden for gold prices, though the metal is still 28% higher for the year so far at $2,624 an ounce .

Oil has had a tougher year as concerns about demand, particularly from China, kept a lid on prices and forced OPEC+ to repeatedly extend a deal to limit supplies.

Brent fell 37 cents to $73.80 a barrel, while U.S. crude lost 17 cents to $70.43 per barrel.