European stocks recorded their worst quarterly showing in more than two years on Tuesday, as uncertainty around interest rates and the Trump administration’s policies halted a rally that had pushed several markets to record highs this year.

The pan-European STOXX 600 added 0.6% on the final trading session of the year, but clocked a quarterly decline of about 3% – its biggest since July 2022.

Trading volumes were thin ahead of the New Year holiday, with bourses in Germany, Italy and Switzerland already closed on Tuesday. Those in France, Spain and the UK had an early close.

“The cautious mood aligns with global trends, as investors pare back positions ahead of the New Year amid uncertainty over monetary policy and the economic outlook under a Trump presidency,” said Matt Britzman, senior equity analyst at Hargreaves Lansdown.

High valuations, climbing Treasury yields and uncertainties about 2025 have all contributed to the risk-off sentiment in the past few sessions on both sides of the Atlantic but the main U.S. indexes have posted strong gains this year.

The S&P 500 has climbed nearly 24% in 2024 while the STOXX 600 is up just 5.9% as slowing European and Chinese economies, automakers’ troubles and France’s political turmoil weighed on the mood.

European shares fall in final full session of 2024

German stocks outperformed broader European markets this year with a near-19% jump, while political instability and concerns about a widening fiscal deficit dragged down France’s CAC 40 by 2.1%.

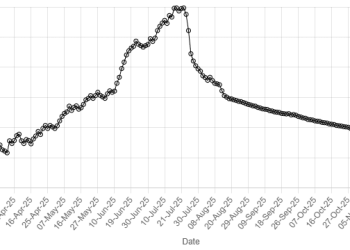

European shares had hit an all-time high in September, riding on the coattails of an AI-driven surge on Wall Street and supported by interest rate cuts from the European Central Bank.

The UK’s FTSE 100 advanced 5% in 2024, its fourth consecutive year of gains.

Sector-wise, banks and insurers led the surge this year, while food and beverage stocks and automakers underperformed.