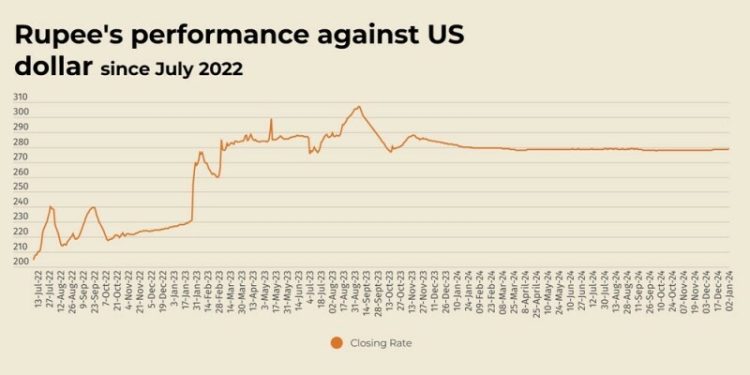

The Pakistani rupee registered a marginal decline against the US dollar, depreciating 0.03% in the inter-bank market on Thursday.

At close, the currency settled at 278.64 for a loss of Re0.09 against the greenback.

The rupee settled at 278.55 on Tuesday, according to the State Bank of Pakistan (SBP).

The currency market remained closed on Wednesday on account of bank holiday.

Internationally, the US dollar kicked off 2025 on the front foot on Thursday after a strong year of gain against most currencies, with the yen sliding toward its lowest level in more than five months as investors ponder US interest rates staying higher for longer.

Market focus early in the year will be on the incoming Trump administration and its policies that are widely expected to not only boost growth but also add to price pressure, underpinning U.S. Treasury yields and boosting dollar demand.

A wide interest rate difference between the US and other economies has cast a shadow over the currency market, resulting in most currencies declining sharply against the dollar in 2024.

The dollar index, which measures the US currency against six others, was at 108.53 in early trade, just shy of the two-year high touched on Tuesday. The index rose 7% in 2024.

Oil prices, a key indicator of currency parity, nudged higher on Thursday, the first day of trade for 2025, as investors returning from holidays cautiously eyed China’s economy and fuel demand following a pledge by President Xi Jinping to promote growth.

Brent crude futures rose 16 cents, or 0.21%, to $74.80 a barrel by 0829 GMT after settling up 65 cents on Tuesday, the last trading day for 2024.

US West Texas Intermediate crude futures gained 16 cents, or 0.22%, to $71.88 a barrel after closing 73 cents higher in the previous session.