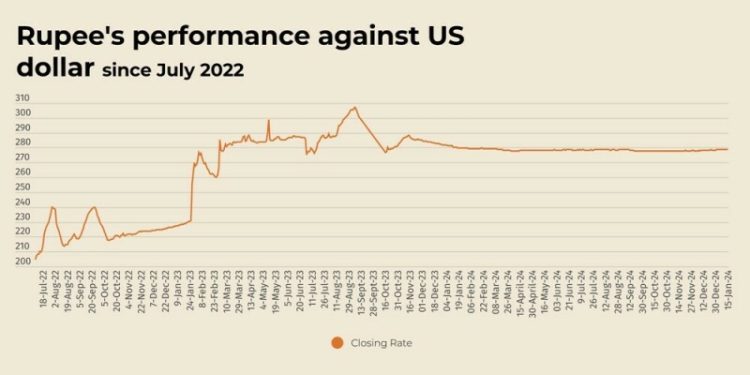

The Pakistani rupee recorded a marginal decline against the US dollar, depreciating 0.02% in the inter-bank market on Wednesday.

At close, the currency settled at 278.77 after a loss of Re0.05 against the greenback.

The rupee closed at 278.72 on Tuesday, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar’s towering rally hit a speed bump on Wednesday as traders turned cautious ahead of a closely watched US consumer inflation report due later in the day, making them hesitant to take on new positions.

The greenback was stabilising in the early Asian session after falling overnight and edging away from a more than two-year peak hit against a basket of currencies at the start of the week.

Its decline came in part due to a tame reading on US producer prices, which pulled Treasury yields off their highs.

Against the US dollar, the euro was some distance from a more than two-year trough and last bought $1.0301.

Ahead of Trump’s inauguration on Jan. 20, investors have been highly sensitive to headlines around his policy plans, which analysts expect will stoke inflation in the world’s largest economy.

The threat of tariffs along with expectations of fewer Fed rate cuts has in turn lifted Treasury yields and supported the greenback.

Against a basket of currencies, the US dollar was last a touch higher at 109.23 , but was some distance away from Monday’s peak of 110.17, its strongest level since November 2022.

Oil prices, a key indicator of currency parity, rose on Wednesday trimming losses from the previous day, as the focus turned back to potential supply disruptions from sanctions on Russian tankers, though gains were capped as the market awaited more clarity on their impact.

Brent crude futures edged up 51 cents, or 0.6%, to $80.43 a barrel by 0735 GMT, after dropping 1.4% in the previous session.

US West Texas Intermediate crude climbed 64 cents, or 0.8%, to $78.14 a barrel after a 1.6% decline.

Prices slipped on Tuesday after the US Energy Information Administration predicted oil would come under pressure over the next two years as supply would outpace demand.