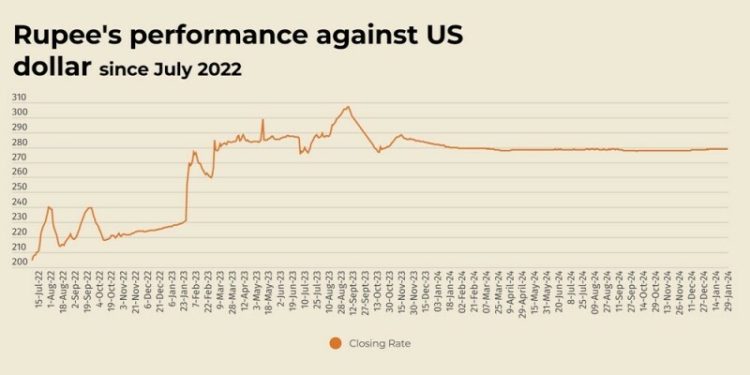

The Pakistani rupee saw marginal improvement against the US dollar, appreciating 0.02% in the inter-bank market on Wednesday.

At close, the currency settled at 278.87 for a gain of Re0.06 against the greenback, according to the State Bank of Pakistan (SBP).

The rupee had closed at 278.93 on Tuesday.

Internationally, the US dollar remained firm after traders rotated back into the currency from safe-haven peers like the Japanese yen, while also getting a boost from fresh tariff warnings from the Donald Trump administration.

The dollar index, which measures the currency against six major rivals, was flat at 107.91 following two days of consecutive 0.2% advances.

It ended last week with a 0.6% tumble, as traders judged US President Donald Trump’s tariffs would be milder than expected following threats of huge levies during the election.

On Tuesday though, the White House reaffirmed plans to hit Canada and Mexico with tariffs on Saturday – which Trump previously said would be 25% – and said the President was also still weighing fresh tariffs on China.

The Mexican peso edged down slightly to 20.5440 per US dollar, while Canada’s loonie was flat at C$1.4402 versus the greenback.

The yen eased about 0.1% to 155.66 per US dollar.

Oil prices, a key indicator of currency parity, fell on Wednesday, following a rise in U.S. crude stockpiles and easing worries over Libyan supply, while the focus turned to potential U.S. tariffs on Canadian and Mexican imports.

Brent crude futures were down 59 cents, or 0.76%, to $77.90 a barrel as of 0916 GMT, while U.S. crude futures had lost 55 cents, or 0.75%, at $73.22.

The White House said on Tuesday that U.S. President Donald Trump still plans to issue 25% tariffs on Canada and Mexico on Saturday.

Inter-bank market rates for dollar on Wednesday

BID Rs 278.87

OFFER Rs 279.07

Open-market movement

In the open market, the PKR gained 6 paise for buying and 9 paise for selling against USD, closing at 278.74 and 280.82, respectively.

Against Euro, the PKR gained 24 paise for buying and 28 paise for selling, closing at 289.91 and 293.20, respectively.

Against UAE Dirham, the PKR lost 1 paisa for buying and remained unchanged for selling, closing at 75.98 and 76.50, respectively.

Against Saudi Riyal, the PKR lost 2 paise for buying and remained unchanged for selling, closing at 74.25 and 74.75, respectively.

Open-market rates for dollar on Wednesday

BID Rs 278.74

OFFER Rs 280.82