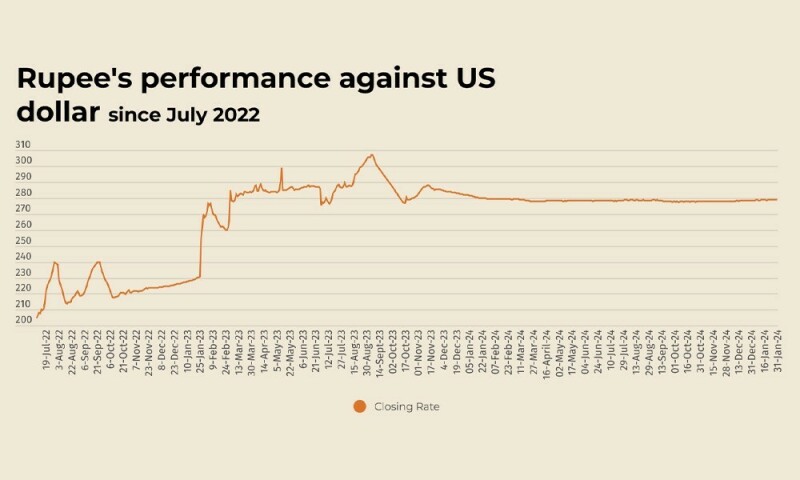

The Pakistani rupee remained largely stable against the US dollar, appreciating 0.01% in the inter-bank market on Friday.

At close, the currency settled at 278.95 for a gain of Re0.02 against the greenback, according to the State Bank of Pakistan (SBP).

The rupee had closed at 278.97 on Thursday.

Internationally, the yen was on track for its best monthly start to the year since 2018 on Friday, helped by the view that the Bank of Japan (BOJ) is likely to keep raising rates this year while its global peers elsewhere look to ease policy.

The Mexican peso and Canadian dollar were on guard ahead of a looming February 1 deadline which US President Donald Trump has said would be the date he imposes 25% tariffs on imports from the two countries.

The loonie languished near a five-year low at C$1.4490 and was set for a weekly decline of 1%.

Mexico’s peso was recovering from its steep fall from the previous session and last stood at 20.6849 per dollar, though it remained on track for its worst weekly performance since October with a roughly 2% fall.

Data on Friday showed core inflation in Tokyo hit 2.5% to mark the fastest annual pace in nearly a year, reinforcing expectations of further rate hikes.

In the broader market, the dollar rose 0.1% to 108.18 against a basket of currencies but was on track for a slight monthly loss of 0.3%.

Data on Thursday showed US economic growth slowed in the fourth quarter, though consumer spending increased at its fastest pace in nearly two years.

Oil prices, a key indicator of currency parity, rose on Friday as markets weighed the threat of tariffs by US President Donald Trump on Mexico and Canada, the two largest crude exporters to the US, that could take effect this weekend.

Brent crude futures for March, which expires on Friday, gained 61 cents at $77.48 a barrel at 0430 GMT.

The more-active April contract was at $76.37 a barrel, up 48 cents.

US West Texas Intermediate crude (WTI) gained 65 cents to $73.38. For the week, Brent is set to fall 1.3% while WTI has declined 1.69%.

However, for the month of January, Brent is set to gain 3.8%, its best month since June, and WTI is poised to climb 2.3%.

Inter-bank market rates for dollar on Friday

BID Rs 278.95

OFFER Rs 279.15

Open-market movement

In the open market, the PKR gained 8 paisa for buying and lost 1.00 paisa for selling against USD, closing at 278.76 and 280.83, respectively.

Against Euro, the PKR gained 44 paise for buying and 74 paise for selling, closing at 289.40 and 292.16, respectively.

Against UAE Dirham, the PKR gained 1 paisa for buying and remained unchanged for selling, closing at 75.98 and 76.50, respectively.

Against Saudi Riyal, the PKR gained 3 paise for buying and remained unchanged for selling, closing at 74.25 and 74.75, respectively.

Open-market rates for dollar on Friday

BID Rs 278.76

OFFER Rs 280.83