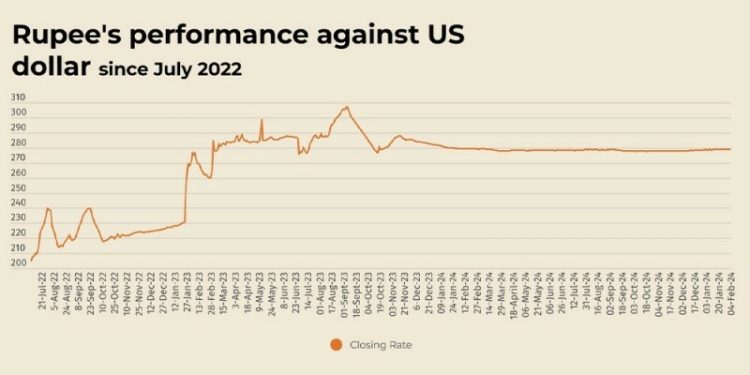

The Pakistani rupee recorded a marginal improvement against the US dollar, appreciating 0.03% in the inter-bank market on Tuesday.

At close, the currency settled at 278.96 for a gain of Re0.08 against the greenback, according to the State Bank of Pakistan (SBP).

The rupee had closed at 279.04 on Monday.

Internationally, the Canadian dollar, Mexican peso and euro were steady against the US dollar on Tuesday following a wild ride on Monday when they rebounded sharply from multi-year lows after US President Donald Trump suspended tariffs on Canada and Mexico by a month.

The Chinese yuan was also firm in offshore trading after recovering from a record trough overnight amid optimism some kind of deal could be reached to avert 10% tariffs on Chinese shipments due to take effect at 12:01 a.m. ET on Tuesday (0501 GMT).

Both Canadian Prime Minister Justin Trudeau and Mexican President Claudia Sheinbaum said late on Monday they had agreed to bolster border enforcement efforts in response to Trump’s demand to crack down on immigration and drug smuggling.

That would pause 25% tariffs due to take effect on Tuesday for 30 days.

The US dollar was flat at C$1.4435 as of 0015 GMT, following a 0.85% retreat on Monday, when it leapt as high as C$1.4792 for the first time since 2003.

The US dollar was 0.3% higher at 20.3939 Mexican pesos, but that followed a 1.7% tumble on Monday, following a push to the highest level in nearly three years at 21.1882.

The US dollar added 0.15% to 7.3126 yuan in offshore trading, following a 0.18% decline on Tuesday, when it pulled back from a record high of 7.3765 yuan.

Oil prices, a key indicator of currency parity, retreated on Tuesday as Trump paused for a month a decision on steep tariffs on Mexico and Canada, the United States’ biggest foreign oil suppliers, while prospects of higher OPEC+ supplies from April also weighed.

Brent futures fell 50 cents, or 0.7%, to $75.46 a barrel by 0432 GMT, while US West Texas Intermediate (WTI) crude declined 89 cents, or 1.2%, to trade at $72.27.

Inter-bank market rates for dollar on Tuesday

BID Rs 278.96

OFFER Rs 279.16

Open-market movement

In the open market, the PKR gained 5 paise for buying and lost 3 paise for selling against USD, closing at 278.70 and 280.91, respectively.

Against Euro, the PKR lost 1.92 rupee for buying and 1.37 rupee for selling, closing at 287.38 and 289.98, respectively.

Against UAE Dirham, the PKR gained 4 paise for buying and remained unchanged for selling, closing at 75.96 and 76.50, respectively.

Against Saudi Riyal, the PKR gained 2 paise for buying and remained unchanged for selling, closing at 74.24 and 74.75, respectively.

Open-market rates for dollar on Tuesday

BID Rs 278.70

OFFER Rs 280.91

The Pakistani rupee recorded a marginal improvement against the US dollar, appreciating 0.03% in the inter-bank market on Tuesday.

At close, the currency settled at 278.96 for a gain of Re0.08 against the greenback, according to the State Bank of Pakistan (SBP).

The rupee had closed at 279.04 on Monday.

Internationally, the Canadian dollar, Mexican peso and euro were steady against the US dollar on Tuesday following a wild ride on Monday when they rebounded sharply from multi-year lows after US President Donald Trump suspended tariffs on Canada and Mexico by a month.

The Chinese yuan was also firm in offshore trading after recovering from a record trough overnight amid optimism some kind of deal could be reached to avert 10% tariffs on Chinese shipments due to take effect at 12:01 a.m. ET on Tuesday (0501 GMT).

Both Canadian Prime Minister Justin Trudeau and Mexican President Claudia Sheinbaum said late on Monday they had agreed to bolster border enforcement efforts in response to Trump’s demand to crack down on immigration and drug smuggling.

That would pause 25% tariffs due to take effect on Tuesday for 30 days.

The US dollar was flat at C$1.4435 as of 0015 GMT, following a 0.85% retreat on Monday, when it leapt as high as C$1.4792 for the first time since 2003.

The US dollar was 0.3% higher at 20.3939 Mexican pesos, but that followed a 1.7% tumble on Monday, following a push to the highest level in nearly three years at 21.1882.

The US dollar added 0.15% to 7.3126 yuan in offshore trading, following a 0.18% decline on Tuesday, when it pulled back from a record high of 7.3765 yuan.

Oil prices, a key indicator of currency parity, retreated on Tuesday as Trump paused for a month a decision on steep tariffs on Mexico and Canada, the United States’ biggest foreign oil suppliers, while prospects of higher OPEC+ supplies from April also weighed.

Brent futures fell 50 cents, or 0.7%, to $75.46 a barrel by 0432 GMT, while US West Texas Intermediate (WTI) crude declined 89 cents, or 1.2%, to trade at $72.27.

Inter-bank market rates for dollar on Tuesday

BID Rs 278.96

OFFER Rs 279.16

Open-market movement

In the open market, the PKR gained 5 paise for buying and lost 3 paise for selling against USD, closing at 278.70 and 280.91, respectively.

Against Euro, the PKR lost 1.92 rupee for buying and 1.37 rupee for selling, closing at 287.38 and 289.98, respectively.

Against UAE Dirham, the PKR gained 4 paise for buying and remained unchanged for selling, closing at 75.96 and 76.50, respectively.

Against Saudi Riyal, the PKR gained 2 paise for buying and remained unchanged for selling, closing at 74.24 and 74.75, respectively.

Open-market rates for dollar on Tuesday

BID Rs 278.70

OFFER Rs 280.91