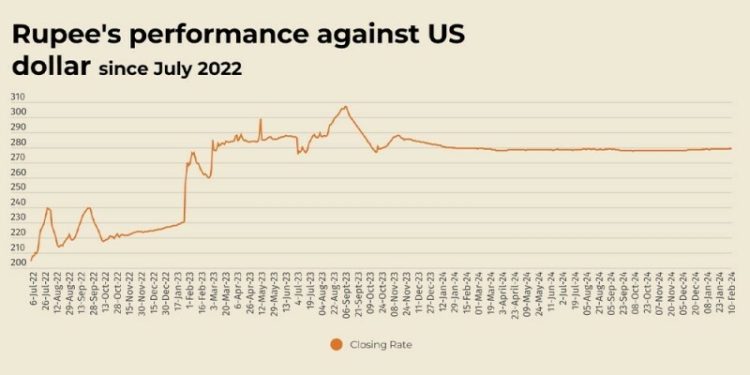

The Pakistani rupee registered a marginal decline against the US dollar, depreciating 0.06% in the inter-bank market on Monday.

At close, the currency settled at 279.22 for a loss of Re0.17 against the greenback, according to the State Bank of Pakistan (SBP).

The rupee depreciated the previous week as it lost Re0.10 or 0.04% in the inter-bank market.

The local unit closed at 279.05, against 278.95 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar firmed on Monday after US President Donald Trump said he was set to impose new 25% tariffs on all steel and aluminium imports, putting pressure on the euro and the commodity-focused Australian and New Zealand dollars.

Trump also said he will announce reciprocal tariffs on Tuesday or Wednesday, applying them to all countries and matching the tariff rates levied by each country.

The move adds to jitters over a global trade war, with China’s retaliatory duties on US goods due to take effect on Monday.

Trump last week kicked off a trade war, first by imposing tariffs on Mexico and Canada and then pausing them, but sticking with duties on Chinese goods.

That led to a measured tit-for-tat response from Beijing suggesting some room for negotiations.

The euro was 0.1% lower at $1.0317 in early trading, close to the more than two-year low of $1.0125 it touched last week as investors braced for tariffs that Trump has repeatedly threatened against Europe.

Beyond Trump, investor focus will be on US inflation data on Wednesday and an appearance by the Federal Reserve Chair Jerome Powell before the House of Representatives on Tuesday and Wednesday, with tariffs likely to be in the spotlight.

Markets are pricing in 36 basis points of cuts this year, down from 42 bps after an upbeat payrolls report on Friday.

The US dollar index, which measures the US currency against six other units, was steady at 108.23 in early trading. Sterling was little changed at $1.23915.

Oil prices, a key indicator of currency parity, ticked higher on Monday even as investors weighed US President Donald Trump’s latest tariff threat, this time on all steel and aluminium imports, which could dampen global economic growth and energy demand.

Brent crude futures climbed 54 cents, or 0.7%, to $75.20 a barrel by 0734 GMT while US West Texas Intermediate crude was at $71.50 a barrel, up 50 cents, or 0.7%.

The market posted its third consecutive weekly decline last week on concerns about a global trade war.

Trump said he will announce on Monday 25% tariffs on all steel and aluminium imports into the US, in another major escalation of his trade policy overhaul.

Just a week ago, the president announced tariffs on Canada, Mexico and China, but suspended those for the neighbouring countries the next day.