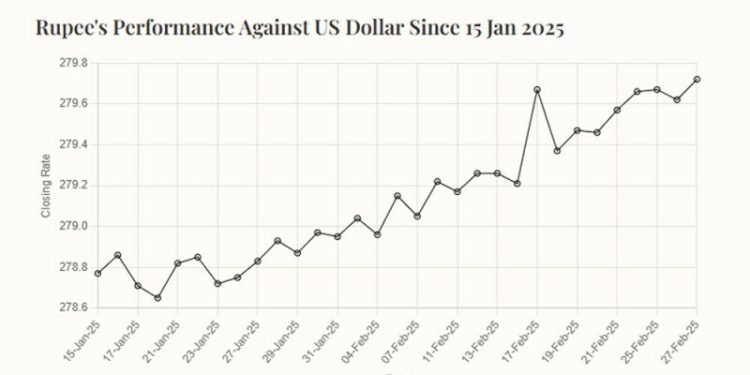

Rupee’s Performance Against US Dollar Since 15 Jan 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“15-Jan-25”, “16-Jan-25”, “17-Jan-25”, “20-Jan-25”, “21-Jan-25”, “22-Jan-25”, “23-Jan-25”,

“24-Jan-25”, “27-Jan-25”, “28-Jan-25”, “29-Jan-25”, “30-Jan-25”, “31-Jan-25”, “03-Feb-25”,

“04-Feb-25”, “06-Feb-25”, “07-Feb-25”, “10-Feb-25”, “11-Feb-25”, “12-Feb-25”, “13-Feb-25”,

“14-Feb-25”, “17-Feb-25”, “18-Feb-25”, “19-Feb-25”, “20-Feb-25”, “21-Feb-25”, “24-Feb-25”, “25-Feb-25”, “26-Feb-25”, “27-Feb-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

278.77, 278.86, 278.71, 278.65, 278.82, 278.85, 278.72, 278.75,

278.83, 278.93, 278.87, 278.97, 278.95, 279.04, 278.96, 279.15,

279.05, 279.22, 279.17, 279.26, 279.26, 279.21, 279.67, 279.37,

279.47, 279.46, 279.57, 279.66, 279.67, 279.62, 279.72

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee recorded marginal decrease, depreciating 0.04% against the US dollar in the inter-bank market on Thursday.

At close, the rupee settled at 279.72, a loss of Re0.10 against the greenback.

On Wednesday, the rupee had closed at 279.62.

Internationally, the US dollar firmed above an 11-week trough on Thursday as vague pledges from President Donald Trump to impose tariffs on Europe and further delays to levies planned for Canada and Mexico stoked uncertainty.

The euro steadied after falling further from a one-month high of $1.0529 in the previous session, as traders took a wait-and-see approach to Trump floating on Wednesday a vague 25% “reciprocal” tariff on European cars and other goods.

The euro was down 0.06% at $1.0479, with traders also awaiting any progress on efforts to form a government in Germany following the election victory of the country.

Trump also said steep 25% tariffs on Mexican and Canadian goods could take effect on April 2 instead of the previously stated deadline of March 4.

But a White House official stated levies on Mexican and Canadian goods remained in effect “as of this moment,” pending Trump’s review of both nations’ actions to secure their borders and halt the flow of migrants and the opioid fentanyl into the United States.

The confusion kept currencies largely within recent ranges, with the Canadian dollar under pressure near a two-week low against the greenback, while the Mexican peso hovered at 20.408.

The dollar index, which measures the US currency against the euro and a handful of other major peers, rose 0.10% to 106.56, edging further off a more than two-month low of 106.12 touched on Monday.

Oil prices, a key indicator of currency parity, climbed for the first time in three days on Thursday, with supply worries resurfacing after Trump announced a reversal of a license given to Chevron to operate in Venezuela.

Brent crude oil futures rose 24 cents or 0.33% to $72.77 a barrel by 0328 GMT. US West Texas Intermediate crude oil futures were up 18 cents or 0.26% at $68.80 per barrel.

A day earlier, the contracts settled at their lowest since December 10 due to a surprise build in US fuel inventories that hinted at weakening demand and hopes for a potential peace deal between Russia and Ukraine.

Both benchmarks have lost about 5% so far this month.

Inter-bank market rates for dollar on Thursday

BID Rs 279.72

OFFER Rs 279.92

Open-market movement

In the open market, the PKR gained 2 paise for buying and lost 1 paisa for selling against USD, closing at 279.13 and 281.30, respectively.

Against Euro, the PKR gained 1.02 rupee for buying and 1.06 rupee for selling, closing at 291.73 and 294.62, respectively.

Against UAE Dirham, the PKR remained unchanged for both buying and selling, closing at 76.05 and 76.60, respectively.

Against Saudi Riyal, the PKR remained unchanged for both buying and selling, closing at 74.33 and 74.85, respectively.

Open-market rates for dollar on Thursday

BID Rs 279.13

OFFER Rs 281.30