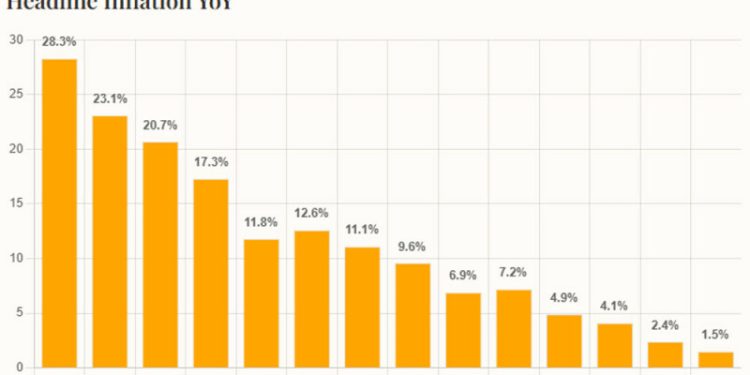

Headline Inflation YoY

Chart.register(ChartDataLabels);

var ctx = document.getElementById(‘inflationChart’).getContext(‘2d’);

var inflationChart = new Chart(ctx, {

type: ‘bar’,

data: {

labels: [“Jan-24”, “Feb-24”, “Mar-24”, “Apr-24”, “May-24”, “Jun-24”, “Jul-24”, “Aug-24”, “Sep-24”, “Oct-24”, “Nov-24”, “Dec-24”, “Jan-25”, “Feb-25”],

datasets: [{

data: [28.3, 23.1, 20.7, 17.3, 11.8, 12.6, 11.1, 9.6, 6.9, 7.2, 4.9, 4.1, 2.4, 1.5],

backgroundColor: ‘orange’,

borderWidth: 1

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

},

datalabels: {

anchor: ‘end’,

align: ‘top’,

formatter: function(value) {

return value + ‘%’;

},

font: {

weight: ‘bold’

}

}

},

scales: {

y: {

beginAtZero: true

}

}

}

});

Pakistan’s headline inflation clocked in at 1.5% on a year-on-year basis in February 2025, a reading below that of January 2025 when it stood at 2.4%, showed Pakistan Bureau of Statistics (PBS) data on Monday.

On a month-on-month basis, CPI decreased by 0.8% in February 2025 as compared to an increase of 0.2% in the previous month and no change in February 2024.

CPI inflation average during 8MFY25 stood at 5.85% as compared to 27.96% in 8MFY24.

Inflation in Pakistan has been a significant and persistent economic challenge, particularly in recent years. In May 2023, the CPI inflation rate hit a record high of 38%. However, it has been on a downward trajectory since then.

Days ago, the Finance Division said that Pakistan’s headline inflation is expected to stay within the 2-3% range in February and may increase to 3-4% by March.

In January, in line with expectations, the Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) reduced the key policy rate by 100 basis points (bps), taking it down to 12%.

This was the sixth successive cut in the key interest rate since June 2024 when it stood at 22%.

After the policy rate decision, Governor SBP Jameel Ahmad back then told a presser that inflation would ease further in January before inching up in the subsequent months.

The MPC is scheduled to meet on March 10, to decide about the new policy rate.

Meanwhile, the latest CPI reading was even lower than the projections made by several brokerage houses.

JS Global projected inflation reading to fall to 2.3% in February 2025.

“Pakistan’s Consumer Price Index (CPI) is set to continue with the disinflation trend, with Feb-2025 CPI likely to fall to 2.29% (lowest since Nov-2015 owing to a high base effect).”

Topline Securities, another brokerage house, gave a similar reading.

“In February, Pakistan’s Consumer Price Index is expected to clock in at 2.0-2.5% year-on-year, taking 8MFY25 average to 6.07% compared to 27.96% in 8MFY24,” Topline said.

Urban, rural inflation

The PBS said CPI inflation urban decreased to 1.8% on year-on-year basis in February 2025 as compared to 2.7% in the previous month and 24.9% in February 2024.

On a month-on-month basis, it decreased by 0.7% in February 2025 as compared to an increase of 0.2% in the previous and corresponding month of last year i.e. February 2024.

CPI inflation rural rate decreased to 1.1% on year-on-year basis in February 2025 as compared to 1.9% in the previous month and 20.5% in February 2024.

On a month-on-month basis, it decreased by 1.1% in February 2025 as compared to an increase of 0.2% in the previous month and a decrease of 0.3% in February 2024.