Safe-haven gold surged to a record high on Friday, trading close to the key $3,000 mark, propelled by ongoing trade war fears and expectations of a rate cut by the US Federal Reserve.

Spot gold was flat at $2,990.54 an ounce, as of 0847 GMT.

Earlier in the session, safe-haven bullion hit a record high of $2,993.80.

US gold futures rose 0.4% to $3,004.20. The bullion scaled 13 all-time highs so far this year and is on track for a second straight week of gains.

“Risk is a bit more to the upside because sentiment towards gold is currently strong and could remain if this chaotic policy making continues,” said Nitesh Shah, commodities strategist at WisdomTree.

US President Donald Trump’s tariffs have played a significant role in raising gold’s demand.

Gold rises as tariff uncertainty, cooler inflation data lend support

The global trade war that has roiled financial markets and raised recession fears is escalating with Trump on Thursday threatening to slap a 200% tariff on alcohol imports from Europe.

“Momentum and haven demand driving a rise in ETF holdings,” has also supported bullion, said Ole Hansen, head of commodity strategy at Saxo Bank, said.

SPDR Gold Trust, the world’s largest gold-backed ETF, said its holdings were at 905.81 metric tons after scaling its highest level since August 2023 in late February.

Meanwhile, data on Wednesday showed consumer prices cooling more than analysts’ expectations, indicating that the Fed could cut its interest rate this year.

The Fed’s next meeting is due on Wednesday, where they are widely expected to keep its benchmark overnight interest rate unchanged.

Traders expect policymakers will resume cutting borrowing costs in June.

“We maintain our bullish stance on gold, with prices expected to reach a record high of $3,050 per ounce in 2025,” analysts at ANZ noted.

Spot silver added 0.5% to $33.96 an ounce, platinum lost 0.2% to $992.15 and palladium gained 1% to $967.42.

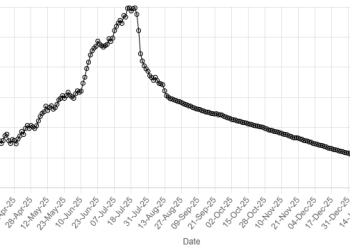

American Dollar Exchange Rate

American Dollar Exchange Rate