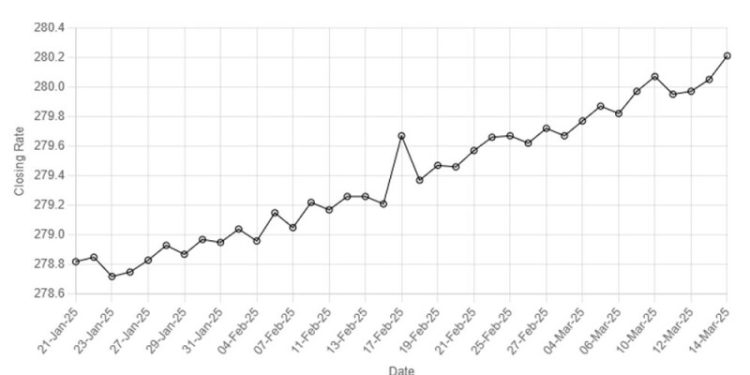

Rupee’s Performance Against US Dollar Since 21 Jan 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“21-Jan-25”, “22-Jan-25”, “23-Jan-25”,

“24-Jan-25”, “27-Jan-25”, “28-Jan-25”, “29-Jan-25”, “30-Jan-25”, “31-Jan-25”, “03-Feb-25”,

“04-Feb-25”, “06-Feb-25”, “07-Feb-25”, “10-Feb-25”, “11-Feb-25”, “12-Feb-25”, “13-Feb-25”,

“14-Feb-25”, “17-Feb-25”, “18-Feb-25”, “19-Feb-25”, “20-Feb-25”, “21-Feb-25”, “24-Feb-25”, “25-Feb-25”, “26-Feb-25”, “27-Feb-25”, “28-Feb-25”, “04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”, “13-Mar-25”, “14-Mar-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

278.82, 278.85, 278.72, 278.75,

278.83, 278.93, 278.87, 278.97, 278.95, 279.04, 278.96, 279.15,

279.05, 279.22, 279.17, 279.26, 279.26, 279.21, 279.67, 279.37,

279.47, 279.46, 279.57, 279.66, 279.67, 279.62, 279.72, 279.67, 279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee saw marginal decline against the US dollar, depreciating 0.06% in the inter-bank market on Friday.

At close, the currency settled at 280.21, a loss of Re0.16 against the greenback.

On Thursday, the rupee had closed at 280.05.

Internationally, the US dollar was broadly firmer on Friday with the euro pulling further away from a five-month peak as markets grappled with escalating global trade tensions and risks of a sharp economic downturn.

Sowing more volatility across markets, US President Donald Trump threatened to hit Europe with a 200% tariff on wine, cognac and other alcohol imports.

The escalating tensions between the traditional allies came after the EU bloc announced plans to impose levies on American whiskey and other products next month, which itself was a response to Trump’s 25% tariffs on steel and aluminium imports that took effect earlier this week.

The intensifying global trade skirmish has fuelled uncertainty and fears about a potentially sharp economic slowdown, with the S&P 500 tumbling into correction territory on Thursday as investors piled into US Treasuries and other safe-haven assets.

The euro edged down to $1.0847 after sliding further off Tuesday’s five-month peak the previous day as the EU-US trade spat rattled markets and Germany struggled to pass a massive spending proposal.

Hopes of an imminent ceasefire between Ukraine and Russia were also fading as Moscow said it supported the US proposal but suggested it would need some serious reworking.

Oil prices, a key indicator of currency parity, rebounded on Friday to recover some of their losses of more than 1% in the previous session, partly due to the diminishing prospects of a quick end to the Ukraine war that could bring back more Russian energy supplies.

Brent crude futures rose 64 cents, or 0.9%, to $70.52 a barrel by 0748 GMT after settling 1.5% lower in the previous session.

US West Texas Intermediate crude was at $67.26 a barrel, up 71 cents, or 1.1%, after closing down 1.7% on Thursday.

Inter-bank market rates for dollar on Friday

BID Rs 280.21

OFFER Rs 280.41

Open-market movement

In the open market, the PKR lost 24 paise for both buying and selling

against USD, closing at 279.85 and 281.86, respectively.

Against Euro, the PKR gained 97 paise for buying and 84 paise for selling, closing at 303.08 and 306.06, respectively.

Against UAE Dirham, the PKR lost 1 paisa for buying and 4 paise for selling, closing at 76.17 and 76.75, respectively.

Against Saudi Riyal, the PKR lost 12 paise for buying and 22 paise for selling, closing at 74.66 and 75.22, respectively.

Open-market rates for dollar on Friday

BID Rs 279.85

OFFER Rs 281.86