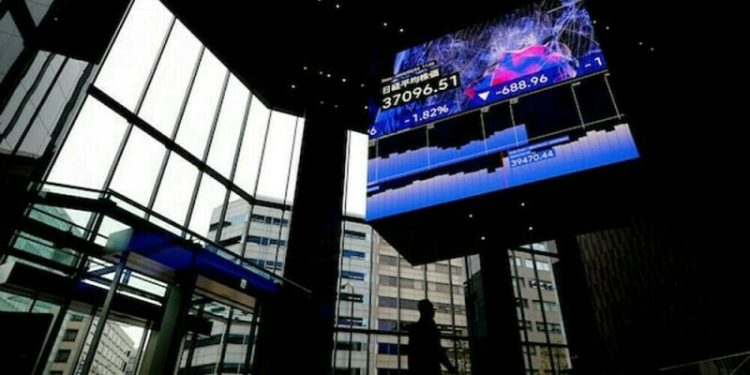

SINGAPORE: Asia shares were hobbled by weakness in Chinese markets on Thursday and struggled to build on Wall Street’s rally, even as investor sentiment was lifted by the prospect that the Federal Reserve could still deliver two rate cuts this year.

The Fed on Wednesday left rates unchanged in a widely expected decision, but maintained its projection for two quarter-percentage-point rate cuts by the year-end.

Policymakers did revise up their inflation forecast for the year and marked down their outlook for economic growth, citing risks from US President Donald Trump’s tariff policies.

Still, investors took comfort from the Fed’s “dot plot” of policy rate expectations and Chair Jerome Powell’s comments that tariff-driven inflation will be “transitory” and largely confined to this year, in turn sending stocks higher while US Treasury yields and the dollar fell.

Australian shares jumped 1%, while US futures also extended their rally after the cash session ended on a high. Nasdaq futures ticked up 0.4% and S&P 500 futures advanced 0.3%. EUROSTOXX 50 futures similarly added 0.1%.

Trading was thinned with Japan markets closed for a holiday, though Nikkei futures edged up 0.2%.

“Reassurance perhaps, but the ongoing path the Fed will tread remains a tight one to navigate, and the central bank remains firmly at the mercy of the incoming data, surveys that can be wholly fickle and market forces that may well still go after a firm response,” said Chris Weston, head of research at Pepperstone.

Gold similarly scaled yet another record high of $3,055.96 an ounce, helped by the prospect of further Fed easing this year.

Trading of cash US Treasuries was closed owing to the Japan holiday, though futures ticked higher, implying lower yields. Bond yields move inversely to prices.

That in turn undermined the dollar, which fell 0.27% against the yen to 148.25, while the euro steadied near a five-month high at $1.0908.

Sterling scaled a four-month top of $1.3015 early in the session, ahead of the Bank of England’s policy decision later on Thursday where it is similarly expected to keep rates on hold.

“We expect the (Monetary Policy Committee) members to signal the desire to see further disinflation as a reason to keep policy on hold this month.

They will affirm that the policy direction remains towards further easing, but the timing will be data-dependent,“ said analysts at ANZ.

China drags

However, the buoyant mood failed to drive a broader rally across Asia, with MSCI’s broadest index of Asia-Pacific shares outside Japan swinging between losses and gains to last trade a marginal 0.1% higher.

That was due to a slide in Chinese equities, with benchmark indexes in mainland China and Hong Kong falling sharply just after the open.

The CSI300 blue-chip index slid 0.66% while the Shanghai Composite Index last traded 0.46% lower. Hong Kong’s Hang Seng Index sank 1.5%.

Asian stocks muted, yen softer ahead of BOJ decision

Analysts said there was no obvious trigger behind the move, and attributed it to some profit-taking after a blistering rally led by technology shares.

Earlier on Thursday, Beijing held its benchmark lending rates steady for the fifth straight month, matching market expectations.

The yuan, which has been pressured by China’s wide yield differentials with the United States, was last little changed at 7.2307 per dollar in the onshore market. Its offshore counterpart was similarly steady at 7.2311 per dollar.

Elsewhere, data showed Australian employment unexpectedly fell in February to end a strong run of impressive gains, although the jobless rate stayed low. The Aussie fell in response to the weaker-than-expected employment figures and last traded 0.27% lower at $0.6341.

Across the Tasman sea, data also out on Thursday showed New Zealand’s economy grew faster than forecast in the fourth quarter, dragging the economy out of recession, but the improvement is not expected to change the central bank’s planned official cash rate cuts.

The New Zealand dollar was last down 0.34% at $0.5797. In commodities, oil prices ticked higher owing in part to an escalation of tensions in the Middle East.

Brent crude futures rose 0.5% to $71.13 a barrel, while US West Texas Intermediate crude (WTI) gained 0.36% to $67.40 per barrel.