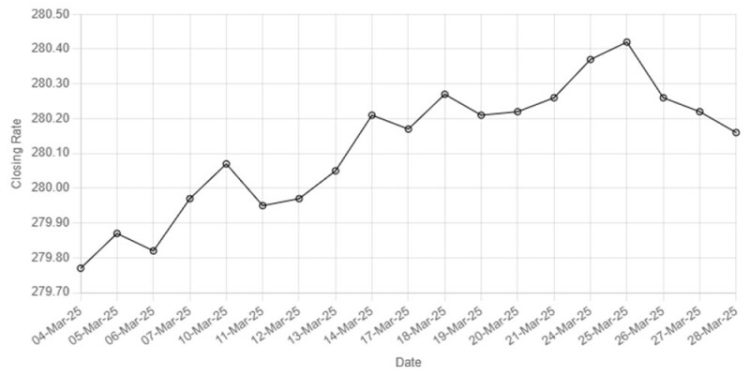

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”,

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee saw marginal improvement against the US dollar, appreciating 0.02% in the inter-bank market on Friday.

At close, the currency settled at 280.16, a gain of Re0.06 against the greenback.

On Thursday, the rupee had closed at 280.22.

Internationally, the US dollar was headed for a steady week on Friday and a quarterly loss next week as concerns about tariffs slowing US growth have pushed down US yields, stocks, and the currency.

The euro, at just below $1.08, was headed for its largest quarterly rise in more than a year, gaining more than 4% since the start of 2025 on a combination of peace prospects in Ukraine, dollar weakness, and a leap in benchmark German yields.

The yen was marginally firmer and set for a quarterly gain just under 4%, at 151.19 per dollar – mostly unruffled by a sticky Tokyo CPI reading.

Later on Friday, France and Spain publish preliminary inflation figures and the US gets February figures for the Federal Reserve’s preferred core PCE inflation gauge.

Anything softer than the 0.3% month-on-month rise, which economists polled by Reuters expect, could keep downward pressure on the dollar and U.S. interest rates.

However, traders are on edge about US President Donald Trump’s pledge to announce sweeping new tariffs next week, which could contain trade into the weekend. He already said 25% levies on imported cars would take effect on April 3.

Oil prices, a key indicator of currency parity, retreated on Friday amid tariff-related demand concerns but headed for a third weekly gain on a tightening global supply outlook after the US placed more pressure on Venezuelan and Iranian oil trade.

Brent crude futures lost 31 cents, or 0.4%, at $73.72 a barrel at 0742 GMT, falling for the first time after daily gains of seven consecutive sessions.

US West Texas Intermediate crude futures were down 33 cents, or 0.5%, to $69.59 a barrel.