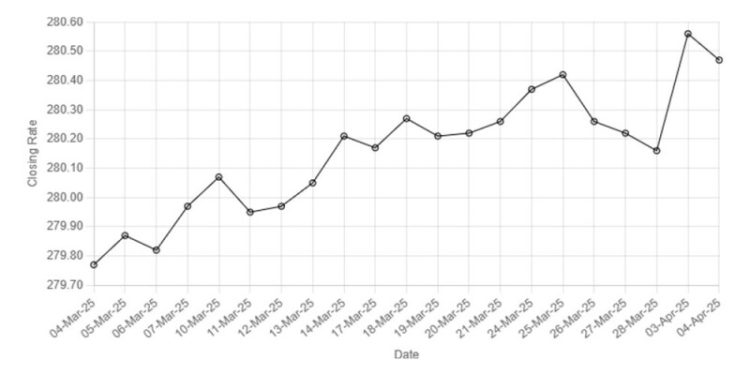

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee saw marginal improvement against the US dollar, appreciating 0.03% in the inter-bank market on Friday.

At close, the currency settled at 280.47, a gain of Re0.09 against the greenback.

On Thursday, the currency settled at 280.56.

Internationally, the US dollar struggled to regain its footing with the safe-haven yen hovering near a six-month peak on Friday, as traders took stock of the fallout from President Donald Trump’s aggressive and far-reaching new tariff measures.

The US dollar was steady after bouncing off six-month troughs to the euro and sterling overnight, with the focus now turning to a crucial monthly US payrolls report later in the day for clues on the health of the economy and the outlook for monetary easing.

Trump’s harsher-than-expected tariffs, announced just over 24 hours earlier, had sent shockwaves through markets. Stocks bore the brunt of a searing selloff, sending investors into the safety of assets such as bonds and gold on fears a full-blown trade war could trigger a global recession and fuel inflation.

The US dollar had already been on the back foot this year after initial euphoria over Trump’s policy agenda morphed into worries that his focus on trade barriers could lead to stagflation or even a US recession.

The US dollar index, a measure of the currency against a basket of six major peers, plunged 1.9% on Thursday, its worst day since November 2022.

The greenback edged down 0.15% to 145.89 yen as of 0057 GMT, after alternating between small gains and losses in early trading on Friday. It slumped 2.2% in the prior session, and dipped as low as 145.19 yen for the first time since October 2.

Oil prices, a key indicator of currency parity, were heading towards their lowest close since the midst of the coronavirus pandemic in 2021 on Friday, hit by US President Donald Trump’s barrage of new tariffs and output increases announced by the OPEC+ producer group.

Brent futures plummeted by $2.29, or 3.3%, to $67.85 a barrel by 0948 GMT.

US West Texas Intermediate crude futures dived by $2.32, or 3.5%, to $64.63.

Both benchmarks were on course for their biggest weekly losses in percentage terms for half a year.

Inter-bank market rates for dollar on Friday

BID Rs 280.46

OFFER Rs 280.66

Open-market movement

In the open market, the PKR gained 10 paise for buying and 1 paisa for selling against USD, closing at 279.89 and 281.98, respectively.

Against Euro, the PKR lost 96 paise for buying and 1.34 rupee for selling, closing at 307.69 and 310.91, respectively.

Against UAE Dirham, the PKR lost 6 paise for buying and 1 paise for selling, closing at 76.11 and 76.74, respectively.

Against Saudi Riyal, the PKR gained 1 paisa for buying and lost 1 paisa for selling, closing at 74.39 and 74.98, respectively.

Open-market rates for dollar on Friday

BID Rs 279.89

OFFER Rs 281.98