Tayfun CoSkun/Anadolu Agency via Getty Images

- 2025 was set to be a bumper year for the aviation industry, but it's not shaping up that way.

- Trump's tariffs have caused fears of reduced demand and more empty seats, worrying investors.

- All major US airlines saw their share prices tumble in the first few months of the year.

Airline bosses predicted 2025 would be their best year yet. Then came tariffs.

While most industries have been hard hit by Donald Trump's trade war, airlines face a particularly bumpy ride. Deutsche Bank analysts said last week that the US airline industry "will face an earnings recession in 2025."

After announcing results in January, Delta Air Lines predicted 2025 would be its most profitable year ever. United Airlines, coming off a stellar year that saw its stock price double, also said it expected even more customers to travel this year.

But now airline CEOs are warning of little to no growth because of worries that demand is sinking as tariffs cause huge economic uncertainty. The situation was further complicated by a series of natural disasters early in the year, which dampened demand.

Delta has already said tariffs are hurting business in an earnings call last week, and with more carriers announcing their first-quarter results in the next two weeks, investors will be watching closely.

Aviation serves as a bellwether for the economic climate, with especially volatile stock charts in recent weeks, because travel is one of the first things to suffer during a slowdown.

If families need to save money, they can more easily forego a vacation than necessities. And for corporations, sending staff on business trips can quickly be seen as an unnecessary luxury. Even those who do still fly may downgrade from highly profitable premium cabins to coach.

This was reflected in the fact that the aviation sector was among the most impacted by the April 2 tariff announcement, with airline stock prices dropping as much as 15% the following day. Then when Trump announced a 90-day pause last Wednesday, airline stocks soared by around a quarter.

Even as the whole stock market has experienced historic volatility since Trump announced tariff plans, the situation has been particularly bad for aviation stocks.

The sector is also facing more volatility because the tariff announcement came before the busy summer travel period when airlines are most profitable.

Even before Trump paused tariffs last Wednesday, airline stocks were rallying that morning. Delta Air Lines jumped 8% in the first hour of trading after posting first-quarter earnings.

Although its financial results weren't particularly special, Wall Street was reassured that maybe things weren't as bad as they thought.

"Despite a somber tone, Delta's conference call contained a number of encouraging observations, culminating in a narrative that was decidedly less negative than we believe many feared (ourselves included)," JPMorgan analysts wrote in a note.

Then came the pause on tariffs and a subsequent boost for the stock market.

Still, Delta had planned for 2025 to be its most profitable year ever. But CEO Ed Bastian warned last week that "growth has largely stalled" due to economic uncertainty.

Now, it has decided not to expand capacity in the second half of the year — which includes the summer travel period. The airline previously planned to grow by 4%.

"Late bookings are extremely important to the airline sector and any weakening of pricing power due to demand softness later in the forward booking curve can have a disproportionate impact on airline profitability," Neil Glynn, a managing director at consulting firm Alvarez & Marsal, told Business Insider.

"Given the traditional resilience of summer travel demand, the winter may prove to be a bigger risk than the peak summer period, and I expect airline management teams to consider post-peak summer capacity plans carefully given elevated demand risks," he added.

Further uncertainties about tariffs and an increased rate for China again upset traders as the market slumped on Thursday.

The S&P 500 dipped 3.5%, while the Big Four airline stocks dropped between 10% and 14%.

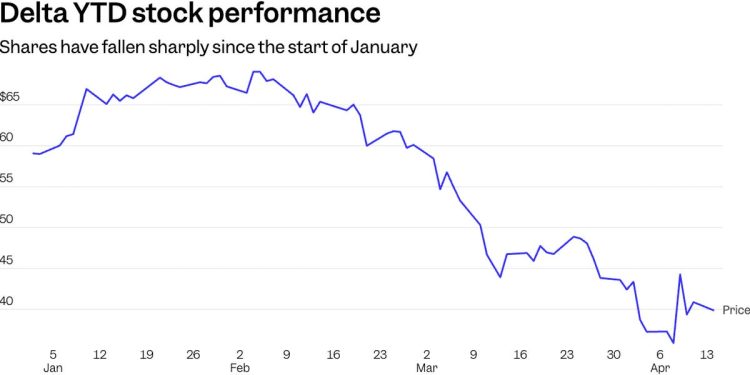

Outside major swings seen last week, airline stocks have broadly plummeted since the start of the year.

United Airlines shares went up nearly 150% last year, but it is down by a third since the start of 2025.

Delta is also down a third, while American Airlines is down 44%. Southwest Airlines, undergoing an overhaul of its business model, is still down nearly a quarter.

The pessimism is based on fears that fewer people will travel than initially expected — leaving airlines with more empty seats.

"We expect a world of slower growth, higher inflation, and a more isolationist US to significantly disrupt the competitive environment for airlines and ground the multiples back in the penalty box over the near term," analysts at TD Cowen wrote in a report.

"The speed at which demand has softened looks to have left airlines with too many domestic seats to sell," they added.

Aviation is a volatile industry, but airlines are well-versed in dealing with difficult circumstances thanks to high costs and thin profit margins.

"This is different uncharted territory for us, but we are used to crises," Air France-KLM CEO Ben Smith said in a broadcast interview with Bloomberg TV last week.

He pointed to European carriers not having the same record profits as US carriers, so they had to put more effort into bringing down costs — even before the pandemic.

Smith also warned that the airline group is seeing "some softness" in economy bookings, but it is lowering prices to fill cabins.

"We're watching it very, very closely," he added.

Virgin Atlantic also said it was seeing a softening in demand for travel from the US to the UK — but not in the other direction. "We think that's quite a natural reaction to the general consumer uncertainty there is in the US at the minute," said chief financial officer Oli Byers.

Tariffs could push ticket prices higher by exacerbating the volatility. As such a global industry, the major planemakers, Boeing and Airbus, rely on worldwide supply chains. Any price increases are expected to be passed down to airlines and, thus, ultimately, to passengers.

Bastian, however, told investors on an earnings call that Delta would not pay for tariffs on Airbus jets and defer deliveries instead.

United Airlines is set to report its first-quarter earnings late Tuesday, and American and Southwest report in the coming two weeks.

Whether they bring good news or bad, expect them all to be asked about tariffs.

American Dollar Exchange Rate

American Dollar Exchange Rate