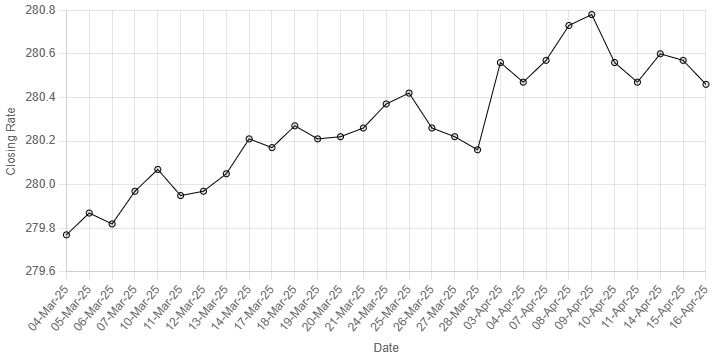

Rupee’s Performance Against US Dollar Since 04 March 2025

The Pakistani rupee saw marginal improvement against the US dollar, appreciating 0.04% in the inter-bank market on Wednesday.

At close, the currency settled at 280.46, a gain of Re0.11 against the US dollar.

On Tuesday, the rupee had closed the day at 280.57.

Internationally, the dollar clung to a small bounce on Wednesday, as investors took a breather from weeks of fairly fierce selling and markets stabilised to wait for progress on US trade talks.

Chinese first quarter GDP data and a batch of March economic indicators are due later in the session, though they will be backward-looking and US Federal Reserve Chairman Jerome Powell is scheduled to speak. The Bank of Canada meets later on Wednesday with a rate cut priced at about a 40% chance.

The euro, which reached three-year highs last week, has eased from a peak of $1.1474 to trade at $1.1311 in the Asia morning. It is up more than 4.5% this month and was overdue a pullback and there has also been little sign of substantive progress toward any deal to avoid heavy U.S. tariffs.

Sterling, however, stood out and notched a six-month high at $1.3254. Britain had been spared the most punitive U.S. levies and overnight U.S. Vice President JD Vance said there was a good chance a trade deal could be struck.

Oil prices, a key indicator of currency parity, edged lower on Wednesday, as shifting U.S. tariff policies fuelled uncertainty, prompting traders to weigh the potential impact of the U.S.-China trade war on economic growth and energy demand.

Brent crude futures eased 18 cents, or 0.3%, to $64.49 per barrel by 0315 GMT, while U.S. West Texas Intermediate crude fell 16 cents, or 0.3%, to $61.17. Both benchmarks fell 0.3% on Tuesday.

Global oil demand is expected to grow at its slowest rate for five years in 2025 and U.S. production rises will also taper off, due to U.S. President Donald Trump’s tariffs on trading partners and their retaliatory moves, the International Energy Agency said on Tuesday.