The Pakistan Stock Exchange (PSX) closed the last session of the week, with its benchmark KSE-100 Index gaining 414 points during trading on Friday.

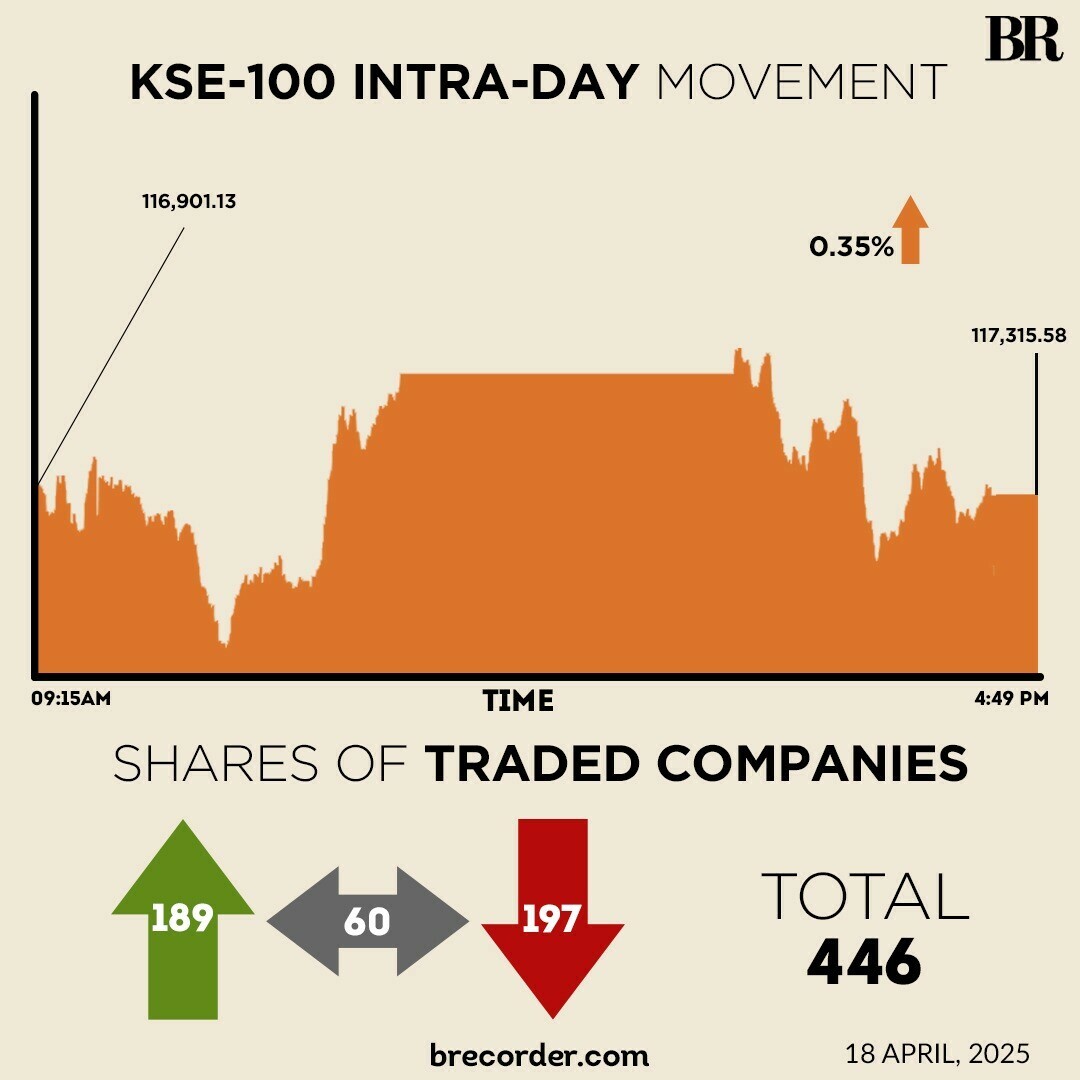

The KSE-100 witnessed some negativity in the initial hours, hitting an intra-day low of 116,759.07.

Buying returned in the latter hours, which pushed the index to an intra-day high of 117,888.13.

At close, followed by some late-session selling, the benchmark index settled at 117,315.59, a gain of 414.45 points or 0.35%.

“KSE-100 Index largely traded in the positive zone during the trading session, which can be attributed to positive news flow – Pakistan recording its highest-ever monthly current account surplus in the month of March,” brokerage house Topline Securities said in its post-market report.

Top positive contribution to the index came from UBL, LUCK , SAZEW, MEBL & SYS, as they cumulatively contributed +913 points to the index, it said.

On Thursday, buying returned to the PSX, with the KSE-100 gaining 881 points.

The KSE-100 witnessed some selling in the initial hours, pushing the index to an intra-day low of 115,818.07.

In a key development, Pakistan’s current account (C/A) posted a significant surplus of $1.2 billion in March 2025, against a deficit of $97 million (revised) last month, data released on Thursday by the State Bank of Pakistan (SBP) showed.

On year-on-year (YoY) basis, the C/A increased 230% against a surplus of $363 million (revised) recorded in the same month last year.

The country posted “highest-ever monthly C/A surplus” in March 2025, according to brokerage houses Topline Securities and Arif Habib Limited.

In another Asian country, China stocks edged down on Friday and looked set to end the week flat, as the market took a breather following US President Donald Trump’s indication of a possible end to the tit-for-tat trade war between the world’s two largest economies.

China’s blue-chip CSI300 Index and the Shanghai Composite Index both dipped 0.4% each. For the week, the CSI300 Index was on track to end up 0.2%.

Meanwhile, the Pakistani rupee posted marginal decline against the US dollar, depreciating 0.03% during trading in the inter-bank market on Friday. At close, the local currency settled at 280.72 against greenback, a loss of Re0.10 as compared to the previous day close.

Volume on the all-share index increased to 425.12 million from 408.07 million recorded in the previous close.

The value of shares declined to Rs34.49 billion from Rs32.13 billion in the previous session.

Sui South Gas was the volume leader with 38.24 million shares, followed by Pak Int.Bulk with 30.96 million shares, and K-Electric Ltd with 22.91 million shares.

Shares of 446 companies were traded on Friday, of which 189 registered an increase, 197 recorded a fall, while 60 remained unchanged.