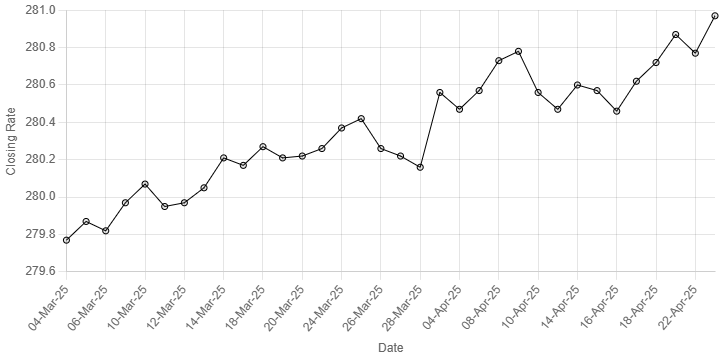

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee registered marginal decline against the US dollar as it depreciated 0.07% in the inter-bank market on Wednesday.

At close, the local currency settled at 280.97 against the greenback, down by Re0.20 against the previous day close.

On Tuesday, the rupee had closed the day at 280.77 against the US dollar.

Internationally, the US dollar rose sharply and then steadied on Wednesday as President Donald Trump backed away from threats of firing Federal Reserve Chair Jerome Powell in a relief to investors while optimism around trade deals lifted beaten down sentiment.

The markets this week have been grappling with the notion that the Fed’s independence could be under threat after repeated attacks by Trump on Powell for not cutting rates since the president resumed office in January.

But late on Tuesday Trump appeared to back down.

“I have no intention of firing him,” Trump told reporters in the Oval Office on Tuesday. “I would like to see him be a little more active in terms of his idea to lower interest rates.”

That left the dollar rising rapidly at the start of the trading day in Asian hours, but it steadied by mid-morning.

The dollar rose more than 1% against the yen to 143.21 in early trading and was last slightly stronger at 141.77. Against the Swiss franc , the dollar was last 0.29% stronger at 0.8216, having jumped more than 1% earlier in the session.

The euro stood at $1.14, while sterling eased 0.17% at $1.3311.

The dollar had been trading near multi-year lows versus the euro and the Swiss franc on Tuesday, while the yen hit a seven month high as investors dumped U.S. assets, worried by trade tensions and Trump’s attacks on the Fed.

Oil prices, a key indicator of currency parity, climbed more than 1% on Wednesday, extending the prior day’s gains, as investors weighed a fresh round of US sanctions on Iran, a drop in US crude stocks and a softer tone from President Donald Trump towards the Federal Reserve.

Brent crude futures climbed $1, or 1.5%, to $68.44 a barrel at 0640 GMT, while US West Texas Intermediate crude was up 99 cents, or 1.6%, at $64.66 a barrel.

The US issued new sanctions targeting Iranian liquefied petroleum gas and crude oil shipping magnate Seyed Asadoollah Emamjomeh and his corporate network on Tuesday.

Emamjomeh’s network is responsible for shipping hundreds of millions of dollars’ worth of Iranian LPG and crude oil to foreign markets, the US Treasury said in a statement.

Inter-bank market rates for dollar on Wednesday

BID Rs 280.96

OFFER Rs 281.16

Open-market movement

In the open market, the PKR lost 2 paise for buying and 12 paise for selling against USD, closing at 280.62 and 282.49, respectively.

Against Euro, the PKR gained 2.56 rupees for buying and 2.53 rupees for selling, closing at 319.30 and 322.60, respectively.

Against UAE Dirham, the PKR gained 13 paise for buying and 12 paise for selling, closing at 76.30 and 77.03, respectively.

Against Saudi Riyal, the PKR lost 26 paise for both buying and selling, closing at 74.95 and 75.63, respectively.

Open-market rates for dollar on Wednesday

BID Rs 280.62

OFFER Rs 282.49