Pakistan’s economy is projected to regain momentum in the ongoing second half (Jan-Jun) of the current fiscal year 2024-25, despite lingering challenges in the agriculture sector, as improving trends in manufacturing, services, and external trade provide a more optimistic outlook, the State Bank of Pakistan (SBP) said in its half-yearly report 2024-25 published on Monday.

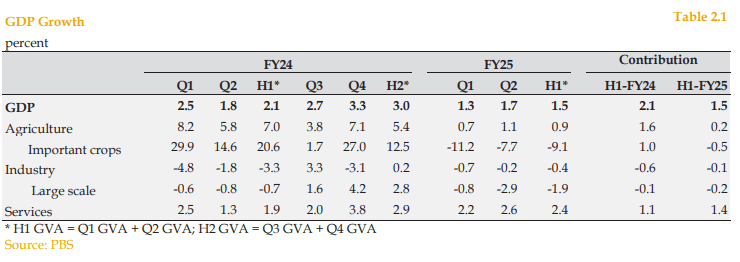

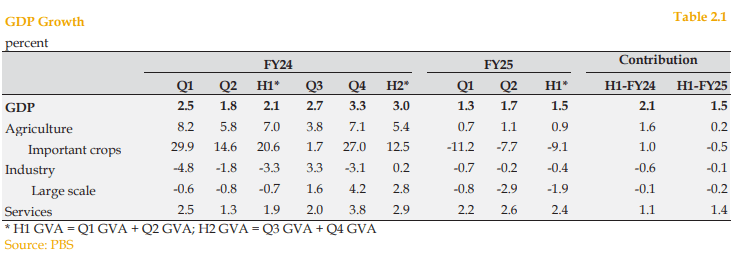

The economy grew by 1.5% in the first six months of FY25, against 2.1% the country recorded in the same period the previous year.

“While growth slowed in first-half of FY25 compared to the same period last year, the latest data on high-frequency indicators suggest that momentum in economic activity is gaining traction,” the central bank said in the report named ‘The State of Pakistan’s Economy’.

Key indicators suggest that the slowdown witnessed in the first half is giving way to a modest yet steady recovery in economic activity, supported by easing financial conditions and declining global energy prices.

Real GDP growth projection remains unchanged in the range of 2.5–3.5% for FY25

According to the central bank report, the recent data exhibited that the Purchasing Managers’ Index (PMI) which is a leading indicator of manufacturing activity, rose to 53.0 in February 2025, the highest since August 2022.

Concurrently, domestic demand indicators such as automobile, cement, and petroleum product sales increased, while high value-added textile exports continued to grow.

These developments hint at a recovery in the industrial and services sectors in the recent times, which are expected to lead economic expansion in the coming months.

However, the agriculture sector remains a concern. The latest estimates point to a lower-than-expected wheat harvest, adding downside risk to overall gross domestic product (GDP) growth.

As a result, “the real GDP growth projection remains unchanged in the range of 2.5–3.5% for FY25”, with risks tilted to the downside due to agricultural underperformance and potential fiscal tightening.

On the domestic front, fiscal accounts showed improvement in the first half of FY25, largely due to sizable profit transfers from the SBP and controlled subsidy outflows. Nevertheless, the fiscal deficit projection remains unchanged at 5.5–6.5% of GDP, as risks persist over revenue shortfalls, according to the half-yearly report.

Inflation, meanwhile, is on a sharp downward trajectory. With global and domestic commodity prices easing and a high base effect fading, “average inflation for FY25 has been revised down significantly to 5.5–7.5%, from earlier estimates of 11.5–13.5%,” SBP said.

The current monetary and fiscal stance, along with sufficient food stockpiles, is expected to keep inflationary pressures contained in the near term.

On the external side, “the current account balance for FY25 is projected in the range of -0.5 to 0.5 percent of GDP.” This is buoyed by stronger-than-expected “growth in workers’ remittances, lower commodity prices, and continuing momentum in exports.” However, as imports rise in tandem with industrial demand, the economy remains vulnerable to any sudden spike in global commodity prices.

Looking ahead, the economic outlook is subject to significant external uncertainties. Rising global protectionism, ongoing geopolitical tensions, and the potential resurgence of global inflation—driven by supply chain disruptions and tariff-induced cost pressures—pose serious challenges for emerging markets like Pakistan.

While domestic recovery appears to be gaining traction, especially in non-agricultural sectors, sustained progress will depend on both prudent policy management and the evolving global economic landscape.