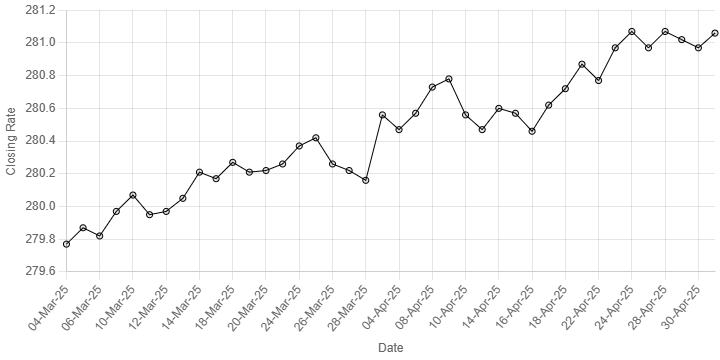

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”, “02-May-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97, 281.06

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

———-

The Pakistani rupee posted marginal decline against the US dollar, depreciating by 0.03% during trading in the inter-bank market on Friday.

At close, the local currency settled at 281.06 against the greenback.

On Wednesday, the rupee closed the day at 280.97. The currency market was closed on Thursday on account of Labour Day.

Internationally, the US dollar headed for a third-straight weekly gain as signs of progress in Washington’s talks with some of its trading partners and better-than-expected data eased concerns over investments in the world’s largest economy.

The dollar, US Treasuries and shares have bounced from steep declines last month as President Donald Trump’s erratic tariff policies drove fears of a recession and sapped confidence in US assets.

Wall Street rallied overnight, driven by positive tech earnings and a slightly better-than-expected manufacturing report, even though it showed factory activity contracted further last month.

The focus now turns to the release of nonfarm payrolls figures later in the day.

The dollar index was little changed in early Asia trading, poised for a 0.5% gain in a week of relatively light trading due to holidays. The greenback traded at 145.53 yen, just off a three-week high reached on Thursday.

Oil prices, a key indicator of currency parity, climbed on Friday after China said it was open for talks with the United States on tariffs, raising hopes of a de-escalation in a bitter trade war between the world’s two largest economies.

Brent crude futures rose 49 cents, or 0.8%, to $62.62 a barrel by 0446 GMT, while US West Texas Intermediate crude futures added 50 cents, or 0.8%, to $59.74 a barrel.

Concerns that the broader trade war could push the global economy into a recession and crimp oil demand, just as the OPEC+ group is preparing to raise output, have weighed heavily on oil prices in recent weeks.

Inter-bank market rates for dollar on Friday

BID Rs 281.05

OFFER Rs 281.25

Open-market movement

In the open market, the PKR lost 2 paise for buying and gained 1 paisa for selling against USD, closing at 281.43 and 282.89, respectively.

Against Euro, the PKR gained 1.13 rupee for buying and 1.27 rupee for selling, closing at 318.45 and 321.36, respectively.

Against UAE Dirham, the PKR lost 4 paisa for buying and remained unchanged for selling, closing at 76.51 and 77.09, respectively.

Against Saudi Riyal, the PKR lost 3 paise for buying and 1 paisa for selling, closing at 75.14 and 75.70, respectively.

Open-market rates for dollar on Friday

BID Rs 281.43

OFFER Rs 282.89