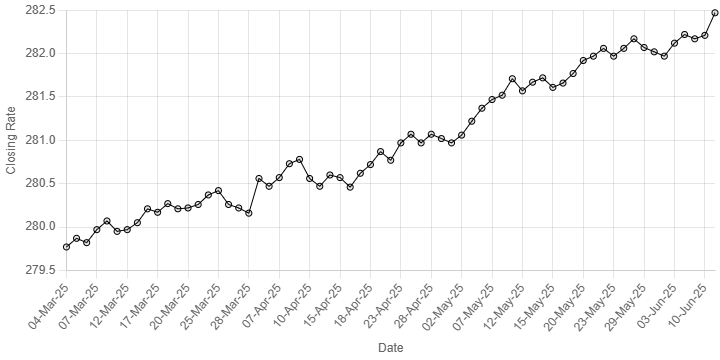

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”, “02-May-25”, “05-May-25”, “06-May-25”, “07-May-25”, “08-May-25”, “09-May-25”, “12-May-25”, “13-May-25”, “14-May-25”, “15-May-25”, “16-May-25”, “19-May-25”, “20-May-25”, “21-May-25”, “22-May-25”, “23-May-25”, “26-May-25”, “27-May-25”, “29-May-25”, “30-May-25”, “02-Jun-25”, “03-Jun-25”, “04-Jun-25”, “05-Jun-25”, “10-Jun-25”, “11-Jun-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97, 281.06, 281.22, 281.37, 281.47, 281.52, 281.71, 281.57, 281.67, 281.72, 281.61, 281.66, 281.77, 281.92, 281.97, 282.06, 281.97, 282.06, 282.17, 282.07, 282.02, 281.97, 282.12, 282.22, 282.17, 282.21, 282.47

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee registered decline against the US dollar, depreciating 0.09% during trading on Wednesday.

At close, the local currency settled at 282.47, a loss of Re0.26 against the greenback.

On Tuesday, the rupee settled at Rs282.21 against the US dollar.

Internationally, the US dollar and China’s yuan were steady on Wednesday as teams from US and China concluded trade talks in London, hinting at a thaw in a damaging trade war between the world’s two largest economies but offering scant detail.

The countries’ officials agreed on a framework based on a trade truce reached last month in Geneva that would resolve China’s export restrictions on rare earth minerals and magnets, and remove some US export restrictions that were recently put in place.

The US dollar firmed slightly in the wake of the news, pushing the euro down 0.07% to $1.141 and steadying at 144.91 yen.

China’s onshore yuan was little changed at 7.1873 per dollar, while the offshore unit stood at 7.1875.

An index that measures the greenback against six other currencies inched up 0.1% and last stood at 99.132.

However, analysts noted that any newly agreed tariffs would still be higher than they were late last year and would thus be a drag on the global economy.

Also keeping investors cautious, a federal appeals court allowed President Donald Trump’s most sweeping tariffs to remain in effect, while it reviews a lower-court decision blocking them on grounds that he had exceeded his authority by imposing them.

Much of the year has been dominated by investors’ unease over Trump’s erratic policies. Despite a bounce back in US stocks, the erosion of investor confidence is clearly reflected in the dollar, which is down more than 8% so far this year.

Oil prices, a key indicator of currency parity, rose to their highest in seven weeks on Wednesday as U.S. President Donald Trump said a deal had been done with China, heightening expectations of a de-escalation in trade tensions between the world’s two largest economies.

Brent crude futures were up $1.15, or 1.7%, to $68.02 a barrel at 1249 GMT, while U.S. West Texas Intermediate crude was up $1.31, or 2%, to $66.29. At that level, WTI reached its highest in more than two months.

Trump said Beijing would supply magnets and rare earth minerals and the U.S. will allow Chinese students in its colleges and universities. Trump added the deal is subject to final approval by him and President Xi Jinping.

Inter-bank market rates for dollar on Wednesday

BID Rs 282.20

OFFER Rs 282.40

Open-market movement

In the open market, the PKR lost 25 paise for buying and 24 paise for selling against USD, closing at 282.78 and 284.64, respectively.

Against Euro, the PKR lost 1.19 rupee for buying and 1.45 rupee for selling, closing at 321.88 and 325.33, respectively.

Against UAE Dirham, the PKR remained unchanged for both buying and selling, closing at 76.72 and 77.48, respectively.

Against Saudi Riyal, the PKR remained unchanged for both buying and selling, closing at 75.00 and 75.75, respectively.

Open-market rates for dollar on Wednesday

BID Rs 282.78

OFFER Rs 284.64