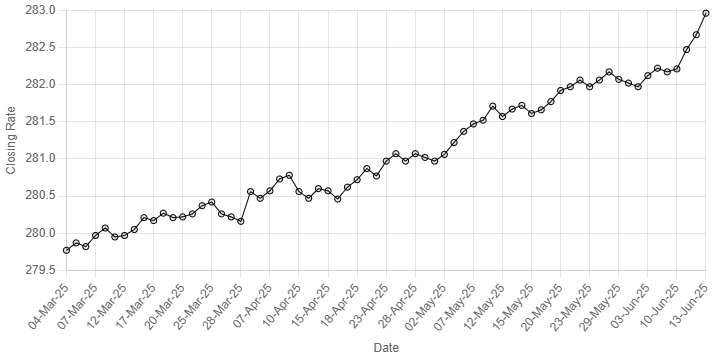

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”, “02-May-25”, “05-May-25”, “06-May-25”, “07-May-25”, “08-May-25”, “09-May-25”, “12-May-25”, “13-May-25”, “14-May-25”, “15-May-25”, “16-May-25”, “19-May-25”, “20-May-25”, “21-May-25”, “22-May-25”, “23-May-25”, “26-May-25”, “27-May-25”, “29-May-25”, “30-May-25”, “02-Jun-25”, “03-Jun-25”, “04-Jun-25”, “05-Jun-25”, “10-Jun-25”, “11-Jun-25”, “12-Jun-25”, “13-Jun-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97, 281.06, 281.22, 281.37, 281.47, 281.52, 281.71, 281.57, 281.67, 281.72, 281.61, 281.66, 281.77, 281.92, 281.97, 282.06, 281.97, 282.06, 282.17, 282.07, 282.02, 281.97, 282.12, 282.22, 282.17, 282.21, 282.47, 282.67, 282.96

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee weakened against the US dollar, depreciating 0.10% on Friday.

At close, the local currency settled at 282.96, a loss of Re0.29 against the greenback.

On Thursday, the rupee settled at Rs282.67 against the US dollar.

Internationally, the US dollar rallied alongside the safe-haven Japanese yen and Swiss franc, with currency markets abruptly reversing direction on news that Israel had launched strikes on Iran.

Israel has begun carrying out strikes on Iran, two US officials told Reuters, adding that there was no US assistance or involvement in the operation.

Another report suggested that explosions were heard northeast of Iran’s capital, Tehran.

An index that measures the dollar against six other currencies gained 0.4%, and was last at 98.07, in early Asia trading.

Against the yen, the dollar slipped 0.35% to 143 per dollar , while the Swiss franc tumbled 0.39% to 0.807 per dollar.

Risk-sensitive Asian currencies such as the Aussie dollar and the New Zealand dollar weakened 0.9% each.

Earlier in the week, the US dollar index hit multi-year lows as investors were unimpressed by a US-China trade truce, while cooler-than-expected inflation data fueled expectations of more aggressive interest rate cuts by the Federal Reserve.

The dollar is on track for weekly declines against the yen, the Swiss franc and the euro.

Oil prices, a key indicator of currency parity, jumped nearly 9% on Friday to near multi-month highs after Israel launched strikes against Iran, sparking Iranian retaliation and raising worries about a disruption in Middle East oil supplies.

Brent crude futures were up $6.19, or around 8.9%, to $75.55 a barrel at 1019 GMT, after hitting an intraday high of $78.50, the highest since January 27.

US West Texas Intermediate crude was up $6.22, or 9.1%, at $74.26 after hitting $77.62, its highest level since January 21.

Friday’s gains were the largest intraday moves for both contracts since 2022, after Russia’s invasion of Ukraine caused a spike in energy prices.

Inter-bank market rates for dollar on Friday

BID Rs 282.96

OFFER Rs 283.16

Open-market movement

In the open market, the PKR lost 27 paise for buying and 30 paise for selling against USD, closing at 283.32 and 285.12, respectively.

Against Euro, the PKR gained 7 paise for buying and 27 paise for selling, closing at 324.87 and 328.57, respectively.

Against UAE Dirham, the PKR gained 1 paisa for buying and lost 3 paise

for selling, closing at 76.95 and 77.72, respectively.

Against Saudi Riyal, the PKR gained 4 paise for both buying and selling,

closing at 75.21 and 75.93, respectively.

Open-market rates for dollar on Friday

BID Rs 283.32

OFFER Rs 285.12