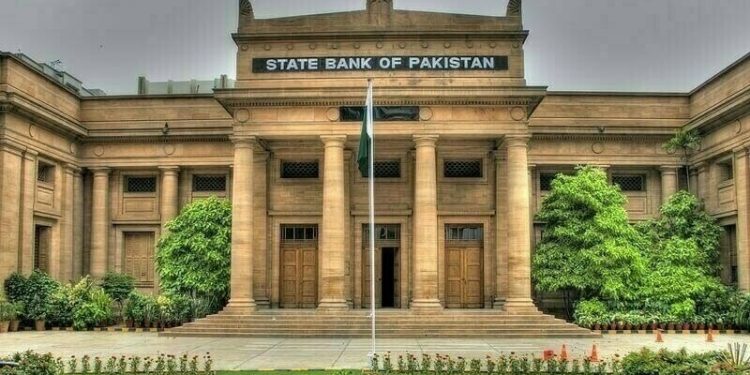

The Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) is expected to hold the key policy rate at 11% in its upcoming meeting scheduled for Monday, market analysts noted.

“While domestic macroeconomic indicators have improved significantly, particularly inflation and the external account, we believe, the central bank is likely to adopt a wait-and-see approach in light of emerging global risks and domestic policy adjustments,” Arif Habib Limited (AHL) said in its report.

The MPC of the central bank will meet on June 16 to decide on the policy rate, the central bank announced on Thursday. The SBP said it will issue the Monetary Policy Statement through a press release on the same day.

In its last meeting held on May 5, 2025, the MPC cut the policy rate by 100 basis points (bps) to 11%.

This was the lowest policy rate since March 2022 (9.75%). The central bank has cut the rate by 1,100bps since June from an all-time high of 22%.

At the time, the MPC noted that inflation declined sharply during March and April, mainly due to a reduction in administered electricity prices and a continued downtrend in food inflation.

AHL, in its report released on Friday, was of the view that while the domestic landscape supports an easing bias, recent geopolitical developments have raised the stakes.

“Escalating tensions in key oil-producing regions have triggered a sharp surge in global oil prices. Benchmark crude contracts, including Brent, WTI, and Arab Light, have risen close to 10-12% WoW, with daily spikes exceeding 6% as of the latest reading.

“For an oil-importing economy like Pakistan, this poses direct and indirect inflationary risks,” AHL noted.

The brokerage house, citing its estimates, said that for every USD 5/bbl increase in global oil prices (on an annualised basis) adds roughly 23bps to headline inflation directly.

“Additionally, any upward revision in domestic energy tariffs, though necessary to prevent further accumulation of circular debt, would carry inflationary implications. The timing and magnitude of these adjustments, alongside changes in food prices, and potential global trade disruptions, could alter the inflation outlook materially,” it shared.

Topline Securities, another brokerage house, also expects the status quo as international crude oil prices have rebounded to US$68-70/barrel amidst rising tensions in the Middle East region and an expected US-China deal.

“This warrants a cautious approach from policy makers, in our view, as oil prices’ movement has remained a major driver of inflation in past.

“Some of the major notifications are also expected before the start of next fiscal year i.e. gas price notification, and electricity price notification, among others,” Topline said in its report.

The brokerage house shared that in its poll, 56% of the market participants expect a status quo in the upcoming monetary policy meeting compared to 31% in the last poll. While 44% are expecting a rate cut of at least 50bps.

Out of the total 44% rate cut participants, 19% are expecting a 50bps cut, and 25% are expecting a 100bps cut, it added.