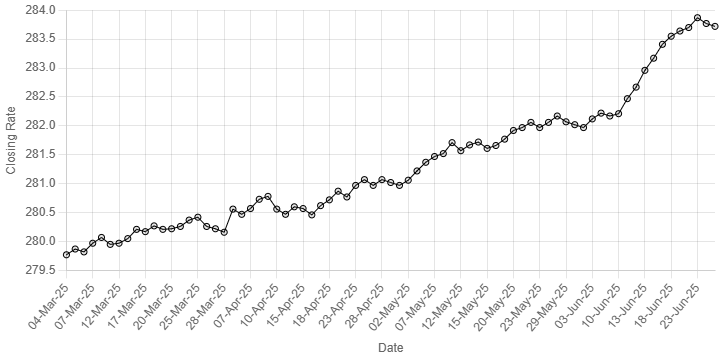

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”, “02-May-25”, “05-May-25”, “06-May-25”, “07-May-25”, “08-May-25”, “09-May-25”, “12-May-25”, “13-May-25”, “14-May-25”, “15-May-25”, “16-May-25”, “19-May-25”, “20-May-25”, “21-May-25”, “22-May-25”, “23-May-25”, “26-May-25”, “27-May-25”, “29-May-25”, “30-May-25”, “02-Jun-25”, “03-Jun-25”, “04-Jun-25”, “05-Jun-25”, “10-Jun-25”, “11-Jun-25”, “12-Jun-25”, “13-Jun-25”, “16-Jun-25”, “17-Jun-25”, “18-Jun-25”, “19-Jun-25”, “20-Jun-25”, “23-Jun-25”, “24-Jun-25”, “25-Jun-25”,

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97, 281.06, 281.22, 281.37, 281.47, 281.52, 281.71, 281.57, 281.67, 281.72, 281.61, 281.66, 281.77, 281.92, 281.97, 282.06, 281.97, 282.06, 282.17, 282.07, 282.02, 281.97, 282.12, 282.22, 282.17, 282.21, 282.47, 282.67, 282.96, 283.17, 283.41, 283.55, 283.64, 283.70, 283.87, 283.77, 283.72

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee posted marginal improvement against the US dollar, appreciating 0.02% during trading in the interbank market on Wednesday.

At close, the local currency settled at 283.72, a gain of Re0.05 against the greenback.

On Tuesday, the rupee settled at 283.77.

Internationally, the US dollar struggled to regain lost ground on Wednesday as investors who have been starved of good news latched onto optimism over a fragile truce between Israel and Iran as a reason to take on more risk.

Markets were jubilant and an index of global shares hit a record high overnight as a shaky ceasefire brokered by US President Donald Trump took hold between Iran and Israel.

The two nations signalled that the air war between them had ended, at least for now, after Trump publicly scolded them for violating a ceasefire he announced.

Investors heavily sold the dollar in the wake of the news, after pouring into the safe-haven currency during the 12 days of war between Israel and Iran that also saw the US attack Iran’s uranium-enrichment facilities.

Currency moves were more subdued in early Asia trade on Wednesday though the euro remained perched near its highest since October 2021 at $1.1621, having hit that milestone in the previous session.

The risk-sensitive Australian dollar, which rallied sharply in the previous session, last traded 0.02% higher at $0.6492.

While the truce between Israel and Iran appeared fragile, investors for now seemed to welcome any reprieve.

Oil prices, a key indicator of currency parity, climbed 2% on Wednesday as investors assessed the stability of a ceasefire between Iran and Israel, while support also came from market expectations that interest rate cuts could happen soon in the United States, the world’s largest economy.

Brent crude futures rose $1.31, or 2%, to $68.45 a barrel at 0750 GMT, while US West Texas Intermediate (WTI) crude gained $1.24 cents, or 1.9%, to $65.61.

Brent settled on Tuesday at its lowest since June 10 and WTI since June 5, both before Israel launched a surprise attack on key Iranian military and nuclear facilities on June 13.

Prices had rallied to five-month highs after the US attacked Iran’s nuclear facilities over the weekend.

Inter-bank market rates for dollar on Wednesday

BID Rs 283.72

OFFER Rs 283.92

Open-market movement

In the open market, the PKR lost 4 paise for buying and gained 5 paise for selling against USD, closing at 284.55 and 285.75, respectively.

Against Euro, the PKR lost 44 paise for buying and remained unchanged for selling, closing at 329.68 and 332.00, respectively.

Against UAE Dirham, the PKR lost 2 paise for buying and remained unchanged for selling, closing at 77.48 and 78.04, respectively.

Against Saudi Riyal, the PKR lost 4 paise for buying and remained unchanged for selling, closing at 75.82 and 76.30, respectively.

Open-market rates for dollar on Wednesday

BID Rs 284.55

OFFER Rs 285.75