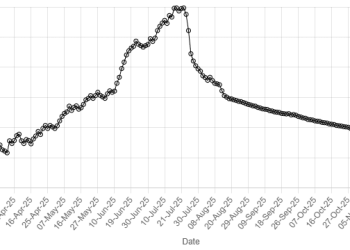

HOUSTON: Oil prices rose on Friday but were set for their steepest weekly decline since March 2023, as the absence of significant supply disruption from the Iran-Israel conflict saw any risk premium evaporate.

Brent crude futures were up 53 cents, or 0.78%, to $68.26 a barrel at 1457 GMT, while US West Texas Intermediate crude was up 59 cents, or 0.9%, to $65.82.

During the 12-day war that started after Israel targeted Iran’s nuclear facilities on June 13, Brent prices rose briefly to above $80 a barrel before slumping to $67 a barrel after US President Donald Trump announced an Iran-Israel ceasefire.

That put both contracts on course for a weekly fall of about 12%.

“The market has almost entirely shrugged off the geopolitical risk premiums from almost a week ago as we return to a fundamentals-driven market,” said Rystad analyst Janiv Shah.

He said the market was also keeping an eye on the July 6 meeting of oil producers group OPEC+, where another output hike of 411,000 barrels per day is expected, while adding that summer demand indicators were key as well.

Phil Flynn, senior analyst with the Price Futures Group, said expectations of higher demand in the coming months were also giving crude a boost on Friday.

“We’re getting a demand premium on oil,” Flynn said.

A possible end to the 19-month war between Israel and Hamas in Gaza and expected agreements between the US, Europe and China on trade were positive signs for the market, he added.

“If we get a trade deal with China, we’re going to be in pretty good shape,” Flynn said.

Prices were also supported by multiple oil inventory reports that showed strong draws in middle distillates, said Tamas Varga, a PVM Oil Associates analyst.

Oil climbs as investors shift focus to demand signals

Data from the US Energy Information Administration on Wednesday showed crude oil and fuel inventories fell a week earlier, with refining activity and demand rising.

Meanwhile, data on Thursday showed that independently held gasoil stocks at the Amsterdam-Rotterdam-Antwerp (ARA) refining and storage hub fell to their lowest in over a year, while Singapore’s middle distillates inventories declined as net exports climbed week on week.

Additionally, China’s Iranian oil imports surged in June as shipments accelerated before the Israel-Iran conflict and demand from independent refineries improved, analysts said.

China is the world’s top oil importer and biggest buyer of Iranian crude.

It bought more than 1.8 million barrels per day of Iranian crude from June 1-20, according to ship-tracker Vortexa, a record high based on the firm’s data.