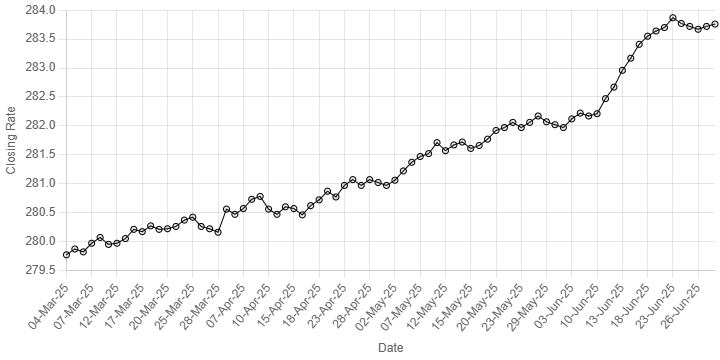

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”, “02-May-25”, “05-May-25”, “06-May-25”, “07-May-25”, “08-May-25”, “09-May-25”, “12-May-25”, “13-May-25”, “14-May-25”, “15-May-25”, “16-May-25”, “19-May-25”, “20-May-25”, “21-May-25”, “22-May-25”, “23-May-25”, “26-May-25”, “27-May-25”, “29-May-25”, “30-May-25”, “02-Jun-25”, “03-Jun-25”, “04-Jun-25”, “05-Jun-25”, “10-Jun-25”, “11-Jun-25”, “12-Jun-25”, “13-Jun-25”, “16-Jun-25”, “17-Jun-25”, “18-Jun-25”, “19-Jun-25”, “20-Jun-25”, “23-Jun-25”, “24-Jun-25”, “25-Jun-25”, “26-Jun-25”, “27-Jun-25”, “30-Jun-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97, 281.06, 281.22, 281.37, 281.47, 281.52, 281.71, 281.57, 281.67, 281.72, 281.61, 281.66, 281.77, 281.92, 281.97, 282.06, 281.97, 282.06, 282.17, 282.07, 282.02, 281.97, 282.12, 282.22, 282.17, 282.21, 282.47, 282.67, 282.96, 283.17, 283.41, 283.55, 283.64, 283.70, 283.87, 283.77, 283.72, 283.67, 283.72, 283.76

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee posted marginal decline against the US dollar, depreciating 0.01% in the interbank market on Monday to end the fiscal year 2024-25 down by 1.95% year-on-year (YoY).

At close on Monday, the currency settled at 283.76, a loss of Re0.04 against the previous day close.

During the previous week, rupee remained largely stable against the US dollar.

The local unit closed at 283.72, marginally lower by Re0.02 or 0.01% against 283.70 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

Pakistan rupee ended the fiscal year 2024-25 down by 1.95% or Rs5.42 against 278.34 it had closed at on the last session of the previous fiscal year.

The local currency remained under pressure due to increasing import demand, according to analysts.

Globally, the US dollar wallowed near its lowest in nearly four years against the euro on Monday as market optimism over US trade deals bolstered bets for earlier Federal Reserve interest rate cuts.

The greenback also languished near a four-year low versus sterling and a more than decade trough to the Swiss franc after Washington and China moved closer to a tariff agreement, even as US President Donald Trump injected some uncertainty into the market’s bullish narrative by abruptly cutting off trade talks with Ottawa.

Investors interpreted Fed Chair Jerome Powell’s testimony to U.S. Congress last week as dovish, after he said that rate cuts were likely if inflation does not spike this summer due to tariffs.

Bets for at least one quarter-point reduction by September have risen to 92.4% according to CME Group’s FedWatch Tool, from about 70% a week earlier.

The US dollar index – which measures the US currency against six major counterparts, including the euro, sterling and franc – edged up 0.1% to 97.276, but was still not far from the more than three-year low of 96.933 late last week.

Oil prices, a key indicator of currency parity, fell 1% on Monday as an easing of geopolitical risks in the Middle East and the prospect of another OPEC+ output hike in August boosted the supply outlook.

Brent crude futures fell 66 cents, or 0.97%, to $67.11 a barrel by 0031 GMT, ahead of the August contract’s expiry later on Monday.

The more active September contract was at $65.97, down 83 cents.

US West Texas Intermediate crude dropped 94 cents, or 1.43%, to $64.58 a barrel.

Last week, both benchmarks posted their biggest weekly decline since March 2023, but they are set to finish higher in June with a second consecutive monthly gain of more than 5%.

Inter-bank market rates for dollar on Monday

BID Rs 283.76

OFFER Rs 283.96

Open-market movement

In the open market, the PKR gained 12 paise for buying and lost 4 paise for selling against USD, closing at 284.83 and 286.14, respectively.

Against Euro, the PKR lost 64 paise for buying and 1.10 rupee for selling, closing at 333.65 and 336.55, respectively.

Against UAE Dirham, the PKR gained 8 paise for buying and 1 paisa for selling, closing at 77.57 and 78.09, respectively.

Against Saudi Riyal, the PKR gained 12 paise for buying and remained unchanged for selling, closing at 75.85 and 76.40, respectively.

Open-market rates for dollar on Monday

BID Rs 284.83

OFFER Rs 286.14