SINGAPORE: Iron ore futures edged higher on Monday, buoyed by strong China trade data, although gains were limited by production curbs in major steelmaking regions in the world’s second-largest economy.

The most-traded September iron ore contract on China’s Dalian Commodity Exchange (DCE) ended daytime trade 0.26% higher at 766.5 yuan ($106.92) a metric ton.

The benchmark August iron ore on the Singapore Exchange was 0.37% higher at $99.65 a ton, as of 0717 GMT.

Iron ore prices have been bolstered by macro news that is fuelling demand, said broker Everbright Futures.

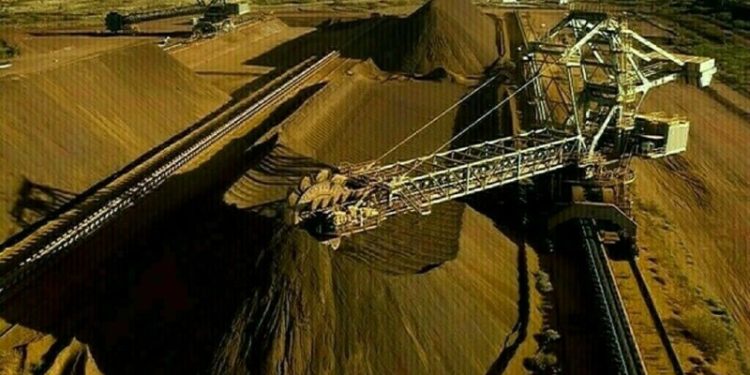

Top consumer China’s iron ore imports in June rose 8% from a month earlier as some miners increased shipments to meet quarterly targets, following a first-quarter slump caused by cyclones in top supplier Australia.

Stronger-than-expected steel demand also boosted appetite for iron ore.

China’s exports gained momentum in June while imports rebounded, as exporters accelerated shipments to take advantage of a fragile tariff truce between Beijing and Washington ahead of an August deadline.

Iron ore heads for third weekly gain on hopes of China supply reforms

Australia’s prime minister, Anthony Albanese, on Monday affirmed his commitment to working with China to tackle global excess steel capacity and promote a sustainable and market-driven sector.

The steel sector has continued to climb, buoyed by positive investor sentiment amid expectations of supply-side reforms, while robust demand from the manufacturing industry has provided strong price support, said broker Galaxy Futures.

Everbright noted that environmental protection-related production restrictions in major steel production hub Hebei province caused a decline in molten iron output of blast furnaces by 10,400 tons month-on-month.

In addition, steelmakers in coal-rich Shanxi province received notifications from authorities to cut their crude steel production this year by 6 million tons, according to Chinese consultancy Mysteel.

Other steelmaking ingredients on the DCE were up, with coking coal and coke up 1.15% and 1.09%, respectively.

Most steel benchmarks on the Shanghai Futures Exchange rose. Rebar was up 0.16%, hot-rolled coil gained 0.09%, wire rod climbed 1.1%, and stainless steel dipped 0.24%.