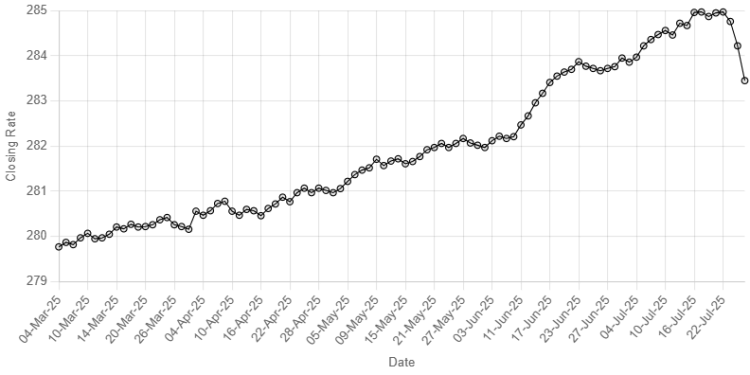

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”, “02-May-25”, “05-May-25”, “06-May-25”, “07-May-25”, “08-May-25”, “09-May-25”, “12-May-25”, “13-May-25”, “14-May-25”, “15-May-25”, “16-May-25”, “19-May-25”, “20-May-25”, “21-May-25”, “22-May-25”, “23-May-25”, “26-May-25”, “27-May-25”, “29-May-25”, “30-May-25”, “02-Jun-25”, “03-Jun-25”, “04-Jun-25”, “05-Jun-25”, “10-Jun-25”, “11-Jun-25”, “12-Jun-25”, “13-Jun-25”, “16-Jun-25”, “17-Jun-25”, “18-Jun-25”, “19-Jun-25”, “20-Jun-25”, “23-Jun-25”, “24-Jun-25”, “25-Jun-25”, “26-Jun-25”, “27-Jun-25”, “30-Jun-25”, “02-Jul-25”, “03-Jul-25”, “04-Jul-25”, “07-Jul-25”, “08-Jul-25”, “09-Jul-25”, “10-Jul-25”, “11-Jul-25”, “14-Jul-25”, “15-Jul-25”, “16-Jul-25”, “17-Jul-25”, “18-Jul-25”, “21-Jul-25”, “22-Jul-25”, “23-Jul-25”, “24-Jul-25”, “25-Jul-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97, 281.06, 281.22, 281.37, 281.47, 281.52, 281.71, 281.57, 281.67, 281.72, 281.61, 281.66, 281.77, 281.92, 281.97, 282.06, 281.97, 282.06, 282.17, 282.07, 282.02, 281.97, 282.12, 282.22, 282.17, 282.21, 282.47, 282.67, 282.96, 283.17, 283.41, 283.55, 283.64, 283.70, 283.87, 283.77, 283.72, 283.67, 283.72, 283.76, 283.95, 283.86, 283.97, 284.22, 284.36, 284.47, 284.56, 284.46, 284.72, 284.67, 284.96, 284.97, 284.87, 284.95, 284.97, 284.76, 284.22, 283.45

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee strengthened against the US dollar, appreciating 0.27% during trading in the inter-bank market on Friday.

At close, the currency settled at 283.45, a gain of Re0.77.

On Thursday, the currency settled at 284.22.

On week-on-week basis, the rupee gained 0.50% against the US dollar, which was the highest in the last 93 weeks, AKD Securities Limited said in a report.

Globally, the US dollar steadied near two-week lows on Friday, on track for its biggest weekly drop in a month, as investors contended with US tariff negotiations ahead of a deadline while looking ahead to central bank meetings next week for clues on policy.

Both the US Federal Reserve and the Bank of Japan are expected to hold rates at next week’s policy meetings, but traders are focusing on the subsequent comments to gauge the timing of the next move.

The prospect of rate hikes by the BOJ had improved, she added, after a trade deal struck with the United States this week lowered tariffs to 15% on auto imports from Japan.

The yen stood at 147.10 to the dollar, on course for a weekly gain of 1%, its strongest such performance since mid-May.

The dollar index, which measures the US currency against six other units, was at 97.448, set for a drop of 1% this week, its weakest performance in a month.

Oil prices, a key indicator of currency parity, rose on Friday, buoyed by optimism over a potential trade deal between the US and the European Union and reports of Russian plans to restrict gasoline exports to most countries.

Brent crude futures gained 17 cents, or 0.3%, to $69.35 a barrel by 0027 GMT. US West Texas Intermediate crude futures climbed 15 cents, or 0.2%, to $66.18 per barrel.

Oil settled 1% higher on Thursday, driven by media reports of expected cuts to Russian gasoline exports.

Inter-bank market rates for dollar on Friday

BID Rs 283.45

OFFER Rs 283.65

Open-market movement

In the open market, the PKR gained 79 paise for buying and 1.05 rupee for selling against USD, closing at 285.46 and 286.55, respectively.

Against Euro, the PKR gained 1.35 rupee for buying and 1.99 rupee for selling, closing at 334.25 and 336.36, respectively.

Against UAE Dirham, the PKR gained 30 paise for buying and 27 paise for selling, closing at 77.53 and 78.00, respectively.

Against Saudi Riyal, the PKR lost 65 paise for buying and gained 27 paise for selling, closing at 75.75 and 76.30, respectively.

Open-market rates for dollar on Friday

BID Rs 285.46

OFFER Rs 286.55