KARACHI: Pakistan central bank has said that the return of stability in the domestic economy has promoted the country “in a better position today to manage external shocks and domestic risks than it was two years ago”.

In its first-ever biannual Monetary Policy Report (MPR) published on Wednesday, the State Bank of Pakistan (SBP) said foreign investment inflows were projected to improve in the wake of the recent upgrade in the country’s sovereign credit rating and the resultant decline in CDS (credit default swap) spreads.

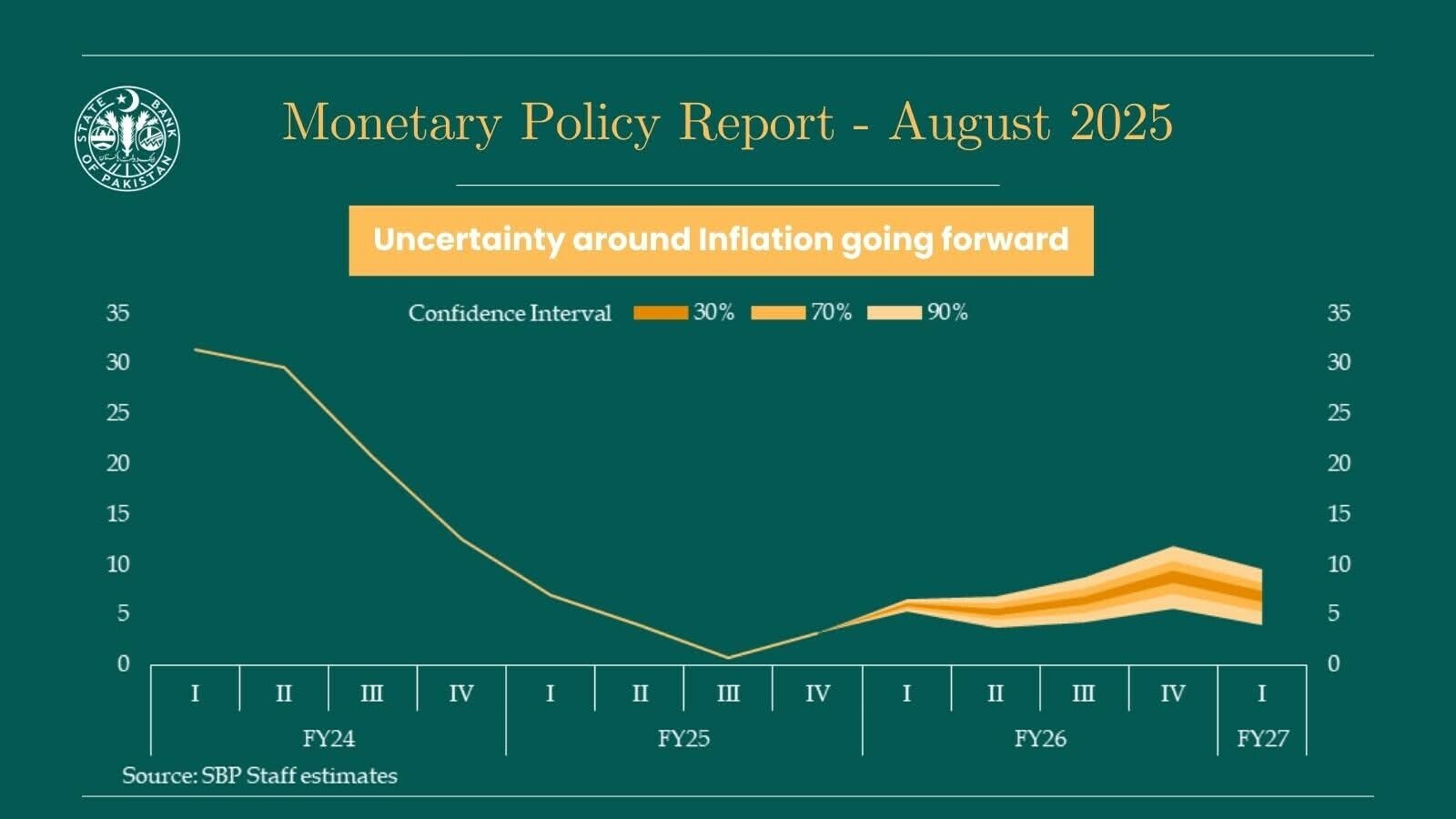

In line with the sharp deceleration in inflation, SBP’s Monetary Policy Committee (MPC) reduced the policy rate by 1,100 basis points to 11% during its meetings from June 2024 to May 2025. It maintained the rate in its meetings held in June and July 2025 on the outlook that the inflation readings would mostly remain in the range of 5–7% during ongoing fiscal year 2025-26.

In this backdrop, “the economic activity is projected to gain further traction, with the impact of the earlier reductions in the policy rate still unfolding,” the central bank said in MPR.

Finance Minister Aurangzeb optimistic on policy rate cut

The bank expects the real policy rate to be adequately positive to stabilise inflation within the medium-term target range of 5–7%. It expects the trade deficit to widen further and, not withstanding continued expected growth in workers’ remittances, result in a current account deficit of 0–1% of GDP in FY26.

The bank said it would publish MPR on biannual basis – within two weeks of every January and July monetary policy meeting. The MPR would provide a detailed and analytical review of the macroeconomic conditions and outlook, assessment of risks to the outlook, and recent considerations in the formulation of monetary policy.

Timely realisation of official financial flows, coupled with continued SBP’s interbank foreign exchange purchases, would support the buildup of SBP reserves, which are projected to rise further to $15.5 billion by end-December 2025 and reach around $17 billion by end-June 2026, according to the report.

Pakistan receives $3.2bn in remittances in July 2025

The central bank acknowledged the recent improvement in macroeconomic dynamics, but also considered potential domestic and global risks to the macroeconomic outlook. “These include volatile international commodity prices, global trade uncertainty, and unanticipated adjustments in domestic administered energy prices.”

It, however, stressed on the importance of “pursuing structural reforms to supplement monetary policy efforts and to achieve higher growth on a sustainable basis – (3.25-4.25% in FY26)”.

The SBP said its primary focus was on economic development and macroeconomic outlook in the recent meetings of the MPC.