Dubai’s main equities index closed higher on Friday, aided by robust corporate earnings and optimism around key talks between U.S. President Donald Trump and Russia’s Vladimir Putin over Ukraine, while Abu Dhabi declined on falling oil prices.

The White House has said the meeting in Alaska will take place at 11 a.m. local time (1900 GMT), with Trump hoping for a ceasefire agreement on Ukraine. Trump has said a second summit involving Ukrainian President Volodymyr Zelenskiy could follow if the talks go well.

Dubai’s main index extended gains to second session with index climbing 0.5%, buoyed by the rise in the materials, financial, and industrial sectors stocks.

Toll operator Salik Company jumped 3.1%, while Emirates Central Cooling Systems Corp. increased 1.2%.

Salik reported nearly 50% increase in its Q2 profit and revenue on Wednesday, while also upgrading its FY25 revenue guidance to 34%-36%.

Among the winners, maritime shipping firm Gulf Navigation Holding surged 3.4% following a fourth consecutive profitable quarter. Firm reported Q2 net profit of AED 7.4 Million ($2.01 million).

Gulf bourses mixed on weaker corporate earnings, Fed rate cut hopes

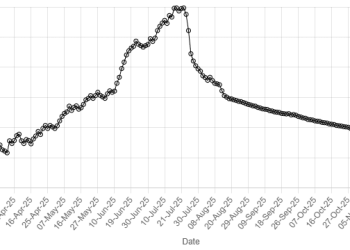

After reaching a 17-and-a-half-year high in July followed by a brief pullback, the Dubai index is regaining momentum and marching towards the previous peak.

However, Abu Dhabi’s benchmark index dropped 0.3%, weighed by a 2.1% decline in UAE’s third largest lender Abu Dhabi Commercial Bank and a 0.9% fall in Abu Dhabi Islamic Bank.

Oil prices – a key catalyst for Gulf’s financial market – came under pressure as investors closely watching the upcoming Trump-Putin meeting in Alaska.

Brent crude slid 0.8% to $66.34 a barrel by 1134 GMT.

“Any potential easing of US sanctions on Russia could lead to increased Russian crude exports, creating volatility in oil prices, said Osama Al Saifi, Managing Director for MENA at Traze.

————————————

ABU DHABI down 0.3% to 10,222

DUBAI .DFMGI up 0.5% to 6,126

————————————