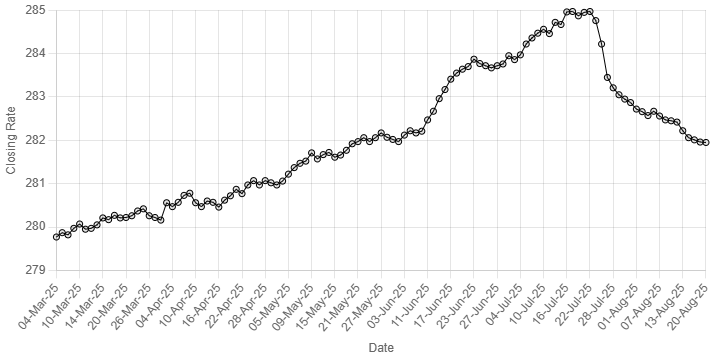

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”, “02-May-25”, “05-May-25”, “06-May-25”, “07-May-25”, “08-May-25”, “09-May-25”, “12-May-25”, “13-May-25”, “14-May-25”, “15-May-25”, “16-May-25”, “19-May-25”, “20-May-25”, “21-May-25”, “22-May-25”, “23-May-25”, “26-May-25”, “27-May-25”, “29-May-25”, “30-May-25”, “02-Jun-25”, “03-Jun-25”, “04-Jun-25”, “05-Jun-25”, “10-Jun-25”, “11-Jun-25”, “12-Jun-25”, “13-Jun-25”, “16-Jun-25”, “17-Jun-25”, “18-Jun-25”, “19-Jun-25”, “20-Jun-25”, “23-Jun-25”, “24-Jun-25”, “25-Jun-25”, “26-Jun-25”, “27-Jun-25”, “30-Jun-25”, “02-Jul-25”, “03-Jul-25”, “04-Jul-25”, “07-Jul-25”, “08-Jul-25”, “09-Jul-25”, “10-Jul-25”, “11-Jul-25”, “14-Jul-25”, “15-Jul-25”, “16-Jul-25”, “17-Jul-25”, “18-Jul-25”, “21-Jul-25”, “22-Jul-25”, “23-Jul-25”, “24-Jul-25”, “25-Jul-25”, “28-Jul-25”, “29-Jul-25”, “30-Jul-25”, “31-Jul-25”, “01-Aug-25”, “04-Aug-25”, “05-Aug-25”, “06-Aug-25”, “07-Aug-25”, “08-Aug-25”, “11-Aug-25”, “12-Aug-25”, “13-Aug-25”, “15-Aug-25”, “18-Aug-25”, “19-Aug-25”, “20-Aug-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97, 281.06, 281.22, 281.37, 281.47, 281.52, 281.71, 281.57, 281.67, 281.72, 281.61, 281.66, 281.77, 281.92, 281.97, 282.06, 281.97, 282.06, 282.17, 282.07, 282.02, 281.97, 282.12, 282.22, 282.17, 282.21, 282.47, 282.67, 282.96, 283.17, 283.41, 283.55, 283.64, 283.70, 283.87, 283.77, 283.72, 283.67, 283.72, 283.76, 283.95, 283.86, 283.97, 284.22, 284.36, 284.47, 284.56, 284.46, 284.72, 284.67, 284.96, 284.97, 284.87, 284.95, 284.97, 284.76, 284.22, 283.45, 283.21, 283.05, 282.95, 282.87, 282.72, 282.66, 282.57, 282.67, 282.56, 282.47, 282.45, 282.42, 282.22, 282.06, 282.01, 281.96, 281.95

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee maintained its upward trend against the US dollar, with marginal appreciation of Re0.01 in the inter-bank market on Wednesday.

At close, the rupee settled at 281.95 against the greenback. This was rupee’s ninth consecutive gain agaisnt the greenback.

On Tuesday, the local unit had closed the session at 281.96.

Internationally, the US dollar gained for a third straight session on Wednesday as traders awaited the Federal Reserve’s annual Jackson Hole symposium this week for clues on the path of monetary policy.

The New Zealand dollar tumbled after the Reserve Bank said its board also considered a half-point cut in deciding to reduce the cash rate by a quarter point.

The kiwi slumped as much as 0.9% to $0.5841, its lowest since April 14.

The US dollar index, which measures the currency against six major counterparts, added 0.1% to 98.438, its highest since August 12. In the first two days of this week, it gained about 0.4%.

Friday’s speech by Fed Chair Jerome Powell is the market’s main focus, as traders watch for any pushback against the market pricing of a rate

reduction next month.

Traders now place odds of 84% on such a cut, and expect about 54 basis points of reduction by year-end.

Oil prices, a key indicator of currency parity, rose on Wednesday as the American Petroleum Institute reported a drop in U.S. crude inventories and investors awaited the next steps in talks to end the Ukraine war, with sanctions on Russian crude remaining in place for now.

Crude fell more than 1% on Tuesday on optimism that an agreement to end the war seemed closer. However, U.S. President Donald Trump conceded that Russian President Vladimir Putin might not want to make a deal.

Brent crude futures rose 71 cents, or 1.1%, to $66.50 a barrel by 1207 GMT. U.S. West Texas Intermediate crude futures for September delivery, set to expire on Wednesday, gained 84 cents, or 1.4%, to $63.19.

Inter-bank market rates for dollar on Wednesday

BID Rs 281.95

OFFER Rs 282.15

Open-market movement

In the open market, the PKR gained 4 paise for buying and 10 paise for selling against USD, closing at 283.73 and 284.30, respectively.

Against Euro, the PKR gained 1.21 rupee for both buying and selling, closing at 329.09 and 330.77, respectively.

Against UAE Dirham, the PKR gained 2 paise for buying and remained unchanged for selling, closing at 77.20 and 77.40, respectively.

Against Saudi Riyal, the PKR gained 2 paise for buying and remained unchanged for selling, closing at 75.48 and 75.70, respectively.

“Open-market rates for dollar on Wednesday*

BID Rs 283.73

OFFER Rs 284.30