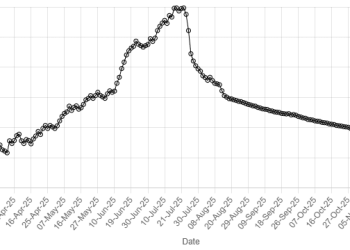

A volatile session was observed at the Pakistan Stock Exchange (PSX), with the benchmark KSE-100 Index shedding over 670 points amid selling pressure due to rollover of futures contracts during trading on Monday.

The market opened on a positive note, pushing the KSE-100 Index to an intra-day high of 150,079.75.

However, investors soon resorted to profit-taking, which dragged the index to an intra-day low of 148,757.13.

At close, the benchmark index settled at 148,815.30, a decrease of 677.75 points or 0.45%.

“The local bourse kicked off rollover week on a volatile note, with a glimpse of profit-taking weighing on sentiment,” brokerage house Topline Securities said in its post-market

On the sectoral front, BAFL, NBP, SEARL, and PABC lent support with a cumulative contribution of 92 points. However, losses in BAHL, SYS, MEBL, HBL, and LUCK dragged the index lower by 394 points, Topline said.

Analysts said the market witnessed profit-taking at the start of the rollover week.

“Approximately, Rs77 billion worth of outstanding future positions need to be rolled over,” Saad Hanif, Head of Research at Ismail Iqbal Securities, told media.

It is pertinent to mention that a rollover week is a period, particularly in futures trading, when existing contracts are closed out and new contracts are opened for the next month, allowing traders to maintain their positions.

During the previous week, Pakistan’s equity market maintained its bullish momentum, amid robust earnings announcements and strong investor participation. The KSE-100 recorded an intra-day high of 151,262 points before closing at 149,493 points, up 3,001 points or 2% week-on-week basis.

Globally, Asian share markets rose on Monday as investors gave a cautious welcome to the likely resumption of US interest rate cuts, while hoping AI-superstar Nvidia’s results this week will help justify the sector’s stratospheric valuations.

Federal Reserve Chair Jerome Powell’s dovish change of course has seen futures price in an 84% chance of a quarter-point rate cut in September, and at least 100 basis points of easing to 3.25-3.5% by the middle of next year.

The shift shoved Treasury yields and the dollar lower, flattering the outlook for corporate earnings, though it also implies policymakers now see more danger of a downturn in employment and the economy.

The market’s euphoria will also be tested by a reading on US personal consumption prices on Friday that is expected to show core inflation creeping up to its highest since late 2023 at 2.9%.

Any upside surprise to inflation would also challenge the rally in longer-dated Treasuries, especially given a whopping $183 billion in new debt is being sold this week.

For now, investors were content to follow Wall Street’s lead and Japan’s Nikkei rose 0.6%. South Korean stocks gained 0.7% and Australia’s index 0.4%.

MSCI’s broadest index of Asia-Pacific shares outside Japan added 1.1%, led by a further 1.0% rise in Chinese blue chips.

The Chinese index has climbed almost 9% so far this month to test peaks from October last year, and a break would take it to ground not seen since mid-2022.

Meanwhile, the Pakistani rupee registered marginal improvement against the US dollar, appreciating 0.01% in the inter-bank market on Monday. At close, the rupee settled at 281.87, a gain of Re0.03 against the greenback. This was rupee’s twelfth successive gain against the greenback.

Volume on the all-share index decreased to 693.30 million from 802.01 million recorded in the previous close.

The value of shares declined to Rs26.34 billion from Rs40.45 billion in the previous session.

Kohinoor Spining was the volume leader with 113.89 million shares, followed by Secure Logistics Gro with 32.59 million shares, and Sui South Gas with 27.05 million shares.

Shares of 479 companies were traded on Monday, of which 204 registered an increase, 246 recorded a fall, while 29 remained unchanged.