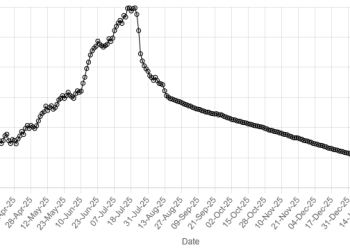

HONG KONG: China’s yuan rallied to a 10-month high against the dollar on Friday, poised for its biggest monthly gain since May, underpinned by firm central bank fixings and a buoyant stock market.

The onshore yuan strengthened to 7.126 per dollar, the strongest since November 6, 2024, before paring some gains to trade largely flat by 0415 GMT.

Its offshore counterpart was little changed at 7.124, after briefly breaching the 7.12 level to hit a 10-month high of 7.1160 overnight.

Recent gains in China’s stock market and expectations the Federal Reserve will cut interest rates next month should help restore investor confidence and support the yuan, said Christopher Wong, FX strategist at OCBC Bank.

“There could be further room for RMB to appreciate should China’s economy see more sustained stabilization.”

The dollar’s six-currency index headed for a monthly fall of 2% on ramped-up bets of an imminent Fed easing.

The yuan is up 1.0% against the dollar this month, and is on track for its biggest gain since May as the People’s Bank of China continued to signal support for a stronger currency with firm daily fixings.

The offshore yuan has also risen 1.2% this month, marking its best performance in a year. Prior to the market opening, the central bank set the midpoint rate at 7.1030 per dollar, 244 pips firmer than a Reuters’ estimate and the strongest level since November 6.

The spot yuan is allowed to trade a maximum of 2% either side of the fixed midpoint each day.

“There has been asymmetric bias for USD/CNY fixing to go lower. This shows PBoC’s intention to engineer gradual RMB appreciation post US-China trade truce mid-May,” Goldman Sachs said in a note, projecting USD/CNH to grind lower to 7.1 in the next 1-2 months and 7.0 by year-end.

Elsewhere, the Hong Kong Interbank Offered Rate (HIBOR) continued to rise across the board, reflecting recent cash withdrawals by the city’s de facto central bank and sharp rebounds in the local dollar.

The overnight tenor climbed above 4% on Friday for the first time since May, marking the largest monthly rebound since records began in 2006.

American Dollar Exchange Rate

American Dollar Exchange Rate