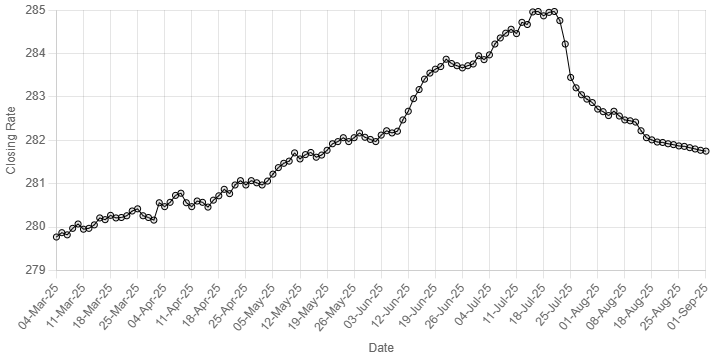

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”, “02-May-25”, “05-May-25”, “06-May-25”, “07-May-25”, “08-May-25”, “09-May-25”, “12-May-25”, “13-May-25”, “14-May-25”, “15-May-25”, “16-May-25”, “19-May-25”, “20-May-25”, “21-May-25”, “22-May-25”, “23-May-25”, “26-May-25”, “27-May-25”, “29-May-25”, “30-May-25”, “02-Jun-25”, “03-Jun-25”, “04-Jun-25”, “05-Jun-25”, “10-Jun-25”, “11-Jun-25”, “12-Jun-25”, “13-Jun-25”, “16-Jun-25”, “17-Jun-25”, “18-Jun-25”, “19-Jun-25”, “20-Jun-25”, “23-Jun-25”, “24-Jun-25”, “25-Jun-25”, “26-Jun-25”, “27-Jun-25”, “30-Jun-25”, “02-Jul-25”, “03-Jul-25”, “04-Jul-25”, “07-Jul-25”, “08-Jul-25”, “09-Jul-25”, “10-Jul-25”, “11-Jul-25”, “14-Jul-25”, “15-Jul-25”, “16-Jul-25”, “17-Jul-25”, “18-Jul-25”, “21-Jul-25”, “22-Jul-25”, “23-Jul-25”, “24-Jul-25”, “25-Jul-25”, “28-Jul-25”, “29-Jul-25”, “30-Jul-25”, “31-Jul-25”, “01-Aug-25”, “04-Aug-25”, “05-Aug-25”, “06-Aug-25”, “07-Aug-25”, “08-Aug-25”, “11-Aug-25”, “12-Aug-25”, “13-Aug-25”, “15-Aug-25”, “18-Aug-25”, “19-Aug-25”, “20-Aug-25”, “21-Aug-25”, “22-Aug-25”, “25-Aug-25”, “26-Aug-25”, “27-Aug-25”, “28-Aug-25”, “29-Aug-25”, “01-Sep-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97, 281.06, 281.22, 281.37, 281.47, 281.52, 281.71, 281.57, 281.67, 281.72, 281.61, 281.66, 281.77, 281.92, 281.97, 282.06, 281.97, 282.06, 282.17, 282.07, 282.02, 281.97, 282.12, 282.22, 282.17, 282.21, 282.47, 282.67, 282.96, 283.17, 283.41, 283.55, 283.64, 283.70, 283.87, 283.77, 283.72, 283.67, 283.72, 283.76, 283.95, 283.86, 283.97, 284.22, 284.36, 284.47, 284.56, 284.46, 284.72, 284.67, 284.96, 284.97, 284.87, 284.95, 284.97, 284.76, 284.22, 283.45, 283.21, 283.05, 282.95, 282.87, 282.72, 282.66, 282.57, 282.67, 282.56, 282.47, 282.45, 282.42, 282.22, 282.06, 282.01, 281.96, 281.95, 281.92, 281.90, 281.87, 281.86, 281.83, 281.8, 281.77, 281.75

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee maintained its positive momentum against the US dollar, appreciating 0.01% in the inter-bank market on Monday.

At close, the rupee settled at 281.75, a gain of Re0.02 against the greenback. This was rupee’s 17th consecutive gain against the greenback.

During the previous week, the Pakistan rupee continued its winning streak as it gained Re0.13 or 0.05% against the US dollar in the inter-bank market.

The local unit closed at 281.77, against 281.90 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

Pakistan’s headline inflation clocked in at 3% on a year-on-year (YoY) basis in August 2025, a reading lower than that of July 2025, when it had stood at 4.1%, showed Pakistan Bureau of Statistics (PBS) data on Monday.

Internationally, the US dollar was adrift on Monday as markets looked ahead to a raft of US labour market data this week that could determine the size of the Federal Reserve’s expected rate cut later this month.

Traders were also still assessing Friday’s US inflation data and a court ruling that most of Donald Trump’s tariffs are illegal, as well as the US president’s ongoing tussle with the Fed over his attempt to fire Governor Lisa Cook.

The dollar rose 0.1% against the yen to 147.20 in the early Asian session, after having clocked a monthly decline of 2.5% against the Japanese currency on Friday.

The euro was up 0.1% to $1.1693, while sterling edged 0.05% higher to $1.3510. US markets are closed for a holiday on Monday.

Investors are currently pricing in an 87% chance the Fed will ease rates by 25bps later this month, according to the CME FedWatch tool.

Against a basket of currencies, the dollar eased 0.04% to 97.79, having clocked a monthly decline of more than 2% on Friday.

Rate expectations aside, the dollar has also been weighed down by worries over Fed independence, as Trump steps up his campaign to exert more influence over monetary policy.

Oil prices, a key indicator of currency parity, rose by more than 1% on Monday on concern over supply disruptions stemming from intensified Russia-Ukraine airstrikes as well as a weaker dollar.

Brent crude was up 80 cents, or 1.2%, at $68.28 a barrel at 1335 GMT. U.S. West Texas Intermediate crude also rose 80 cents, or 1.3%, to $64.81. Trading is expected to be muted because of a U.S. public holiday.

Brent and WTI crude registered their first monthly declines in four months in August, losing 6% or more on increased supply from the OPEC+ producer group.

Inter-bank market rates for dollar on Monday

BID Rs 281.75

OFFER Rs 281.95

Open-market movement

In the open market, the PKR gained 2 paise for buying and 3 paise for selling against USD, closing at 282.75 and 283.57, respectively.

Against Euro, the PKR lost 1.96 rupee for buying and 1.91 rupee for selling, closing at 330.61 and 332.55, respectively.

Against UAE Dirham, the PKR remained unchanged for both buying and selling, closing at 76.96 and 77.20, respectively.

Against Saudi Riyal, the PKR remained unchanged for both buying and selling, closing at 75.26 and 75.50, respectively.

Open-market rates for dollar on Monday

BID Rs 282.75

OFFER Rs 283.57