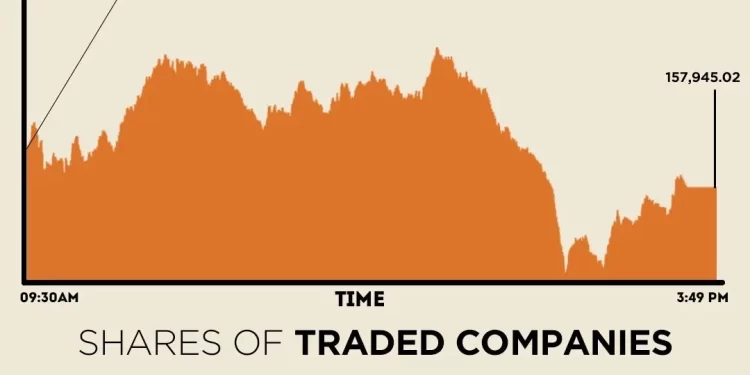

The Pakistan Stock Exchange (PSX) witnessed volatile session on Tuesday, with its benchmark KSE-100 Index closing higher by nearly 400 points after late-selling trimmed the intra-day gains of over 1,200 points.

The KSE-100 started the session positive, hitting an intra-day high of 158,831.22, followed by selling that pushed the index to an intra-day low of 158,831.22.

At close, the benchmark index settled at 157,945.03, up by 390.36 points or 0.25%.

Gains in UBL, BWCL, and BAHL collectively added 432 points to the index. However, losses in LUCK, MEBL, HBL, FFC, and BOP by 255 points, brokerage house Topline Securities said in its post-market report.

On Monday, the PSX ended on a bearish note as investors opted for profit-taking after last week’s robust rally, dragging the index down. The KSE-100 fell 482.71 points, or 0.31%, to close at 157,554.66 points.

Pakistan has requested unilateral tariff concessions from China on approximately 700 items as part of the third phase of the China-Pakistan Free Trade Agreement (CPFTA), currently under negotiation.

According to the Ministry of Commerce, Pakistan’s exports to China have increased following the second phase of the CPFTA. However, Pakistan’s preferential market access has eroded due to China’s FTAs with other trading partners.

Globally, Asian share markets looked to build on recent hefty gains on Tuesday as optimism around all things AI sucked money into the tech sector, while wagers on several more U.S. interest rate cuts kept gold on a hot streak.

Wall Street had been led to another record as Nvidia announced it would invest up to $100 billion in OpenAI, with the first data centre gear to be delivered in the second half of 2026.

The seemingly inexorable rise in tech was attracting money from momentum funds and option players, becoming almost self-fulfilling.

The metal hit a fresh record at $3,755.47 per ounce, nearly 9% higher for the month so far.

The rush into tech has been a boon for chip sectors in many Asian markets, with South Korean stocks up 0.2%, having surged almost 9% this month.

Japan’s Nikkei was closed for a holiday but has climbed 6.5% so far in September, while Taiwan has risen almost 7%.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.3%, to be 5.5% higher on the month.

Chinese blue chips nudged up 0.1%.

Meanwhile, the Pakistani rupee maintained its positive momentum against the US dollar, appreciating 0.01% in the inter-bank market on Tuesday. At close, the rupee settled at 281.42, a gain of Re0.03 against the greenback. This was the rupee’s 33rd successive gain against the greenback.

Volume on the all-share index decreased to 1,521 million from 1,665 million recorded in the previous close. The value of shares declined to Rs58.72 billion from Rs60.90 billion in the previous session.

K-Electric Ltd was the volume leader with 446.65 million shares, followed by Pace (Pak) Ltd with 89.16 million shares, and Cnergyico PK with 61.67 million shares.

Shares of 486 companies were traded on Tuesday, of which 195 registered an increase, 261 recorded a fall, while 30 remained unchanged.