Finance Minister Muhammad Aurangzeb on Thursday said that Pakistan is ‘well-positioned’ to repay a $1.3 billion Eurobond maturing in April next year. The assurance comes as the federal minister highlighted improved macroeconomic stability and a more predictable financing outlook.

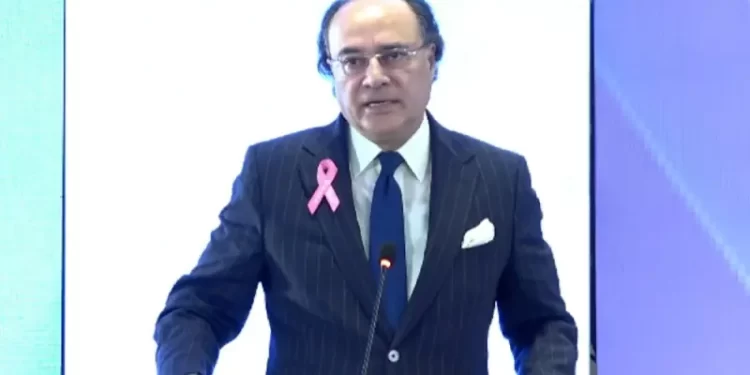

“We repaid $500 million Eurobond on September 30, a total non-event. We are well-positioned to pay off $1.3 billion Eurobond, which is due to mature in April 2026,” said Aurangzeb, in this address at the Pakistan Business Summit, organised by the Nutshell Group, in Peshawar.

The summit, organized under the patronage of the Governor of Khyber Pakhtunkhwa, carried the theme “Shaping What’s Next” and brought together policymakers, business leaders, and corporate executives to deliberate on Pakistan’s economy, innovation, and global competitiveness. The one-day event was co-hosted by Nutshell Group and Al Baraka Bank (Pakistan) Limited, with the Overseas Investors Chamber of Commerce and Industry (OICCI) as Strategic Partner.

Pakistan successfully repaid its $500 million Eurobond, which matured on September 30, 2025, the Ministry of Finance announced on Wednesday. Issued in 2015 to global investors with a 10-year tenor, the bond matured on September 30, 2025.

The finance minister also shared that remittance inflows into the formal economy have increased. “Last year, we had $38 billion in remittances. This year, we expect $41–43 billion.”

Aurangzeb was of the view that the policy rate, which remains at 11%, is expected to be lowered in the ongoing fiscal year. “Although the policy rate is very much the domain of the central bank, I think there is enough cushion that we can continue to push the rate south during the course of this fiscal year,” he said.

Aurangzeb expressed that to take the private sector forward, “it has to be concurrently accompanied with a structural reform agenda”.

He said that the government needs to revive the trust and credibility of tax authorities in Pakistan. “We are making progress in both deepening and widening the tax base,” he said.

The finance minister shared that the budget for the next fiscal year would be delivered by the tax policy office of the Finance Division.

On the privatisation front, Aurangzeb said that 24 state-owned enterprises have been handed over to the Privatisation Commission.

The finance minister informed that Pakistan’s development budget for the ongoing fiscal year is Rs4.3 trillion (including both federal and provincial budgets), which is about $12-13 billion. “We have enough to spend if our prioritisation is correct on how to use these funds, and the coordination between the federation and the provinces,” he said.

Aurangzeb said that instead of appealing to the United Nations, the government can repurpose these funds in terms of rescue and relief in the wake of recent floods, which devastated large swathes of agricultural land in Pakistan.

On FDI, the finance minister said that the recent visits to Beijing, Riyadh, New York, and Washington have yielded tangible results. In China, we signed 24 joint ventures — not just memorandums of understanding (MoUs).

“So these are all key markets and important bilateral partners for us, who have helped us with the Fund programme. But more importantly, going forward, is the trade and investment flow, which we expect,” he said.

Talking about trade with the United States, Aurangzeb shared that both countries have reached important understandings in minerals, IT, AI, agriculture, and pharma.

“I do think we have landed well on a relative basis in terms of the tariff.”

The federal minister reiterated that the government is also preparing to re-enter international capital markets. “By year-end, we expect to issue our first Panda bond in China — tapping the world’s second-largest capital market,” he said.