LONDON: Aluminium prices rose to a one-week high on Friday, supported by persistent supply concerns, while copper was set for a third weekly loss as inventories keep rising.

London Metal Exchange benchmark three-month aluminium was up 0.5% at $3,083 a metric ton by 1045 GMT after touching $3,103 for its strongest since February 13.

LME aluminium has slipped 8% since hitting $3,356 a ton on January 29, its highest since April 2022.

“Aluminium continues to outperform the complex because supply growth remains constrained globally, making it more sensitive to small improvements in sentiment,” said ING commodities strategist Ewa Manthey.

Output in leading producer China has recently reached the government-mandated annual production cap of 45 million tons while another smelter has shut in the U.S. because of high power prices.

The rest of the market was mixed in moderate volumes owing to the closure of the Shanghai Futures Exchange for Lunar New Year holidays. The market reopens on February 24.

“There’s been some week-end squaring after a volatile run, and some light adjustment ahead of Chinese participants returning next week, when liquidity and price discovery typically improve,” Manthey said.

LME copper was little changed at $12,811.50 a ton and on course for a weekly decline of about 1%.

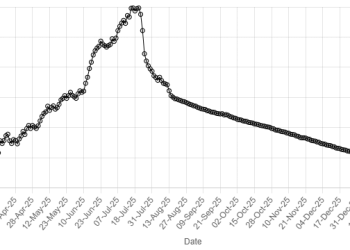

Copper stocks in LME-approved warehouses climbed by 9,575 tons to 235,150 tons, data showed on Friday, for the highest level since March 2025. Inventories have shot up by 65% so far this year.

Weighing on the broader metals market was a firmer dollar, which was on track for its largest weekly gain since October after a run of better than expected economic data and a more hawkish Federal Reserve outlook.

A stronger dollar makes commodities priced in the U.S. currency more expensive for buyers using other currencies.

Among other metals, LME zinc ticked up 0.1% to $3,341.50 a ton, nickel added 0.2% to $17,320 and tin gained 0.7% to $45,945 while lead lost 0.2% to $1,950.50.

American Dollar Exchange Rate

American Dollar Exchange Rate