The Dubai index ended Friday on a positive note, led by investor optimism that U.S. interest rates could decline further this year, while Abu Dhabi headed in the opposite direction to finish lower.

U.S. President Donald Trump said on Thursday he would nominate Council of Economic Advisers Chairman Stephen Miran tofill a vacant seat at the Fed for a few months, while the White House seeks a permanent addition to the central bank’s governing board and continues its search for a new chair.

Miran holds similar views to Trump, who has berated Chair Jerome Powell for being “too late” in cutting interest rates, even though growth is holding up and inflation is ticking higher.

The Fed’s decisions impact monetary policy in the Gulf, where most currencies, including the UAE dirham, are pegged to the U.S. dollar.

Dubai’s main index rebounded on Friday, recovering from two sessions of losses with the index settling 0.3% higher.

Gains were underpinned by a 5.3% surge in Amlak Finance and a 0.6% increase in Emirates Central Cooling Systems Corporation.

State-run utility giant Dubai Electricity And Water Authority rose 0.4% after second-quarter net profit jumped more than 25% to 2.26 billion dirhams ($615.3 million).

Gulf equities end mixed on corporate earnings; Egypt on new record high

By contrast Abu Dhabi’s benchmark index slipped 0.1%, weighed down by a 1.2% decline in Sharjah-based Dana Gas and a 2% decline in UAE’s largest telecom provider Emirates Telecommunication Group (better known as E&).

Dana Gas reported a 12% decrease in its second-quarter net profit to AED 112 million ($30.5 million) on the back of reduced oil production volumes.

Losses in the index were offset by a 0.8% rise in hypermarket operator Lulu Retail Holdings and a 1.7% gain in data analytical firm Alpha Data ahead of their earnings next week.

Oil – a key contributor to Gulf economies – was stable at 0.69% to $66.89 a barrel by 1140 GMT.

————————————-

ABU DHABI down 0.1% to 10,312

DUBAI DFMGI up 0.3% to 6,149

————————————-

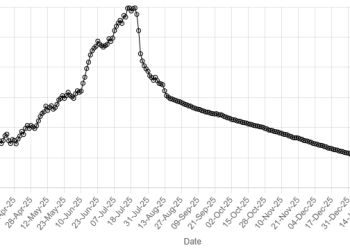

American Dollar Exchange Rate

American Dollar Exchange Rate