SINGAPORE: Stocks in Asia made an uneven recovery as traders assessed the policy options facing the world’s central banks, after an unexpected spike in producer price data in the U.S. renewed inflation concerns.

MSCI’s broadest index of Asia-Pacific shares outside Japan was down 0.2% after a report on Thursday from the Bureau of Labor Statistics which showed the Producer Price Index increased 0.9% in July on a month-on-month basis, well above economists’ expectations.

The report prompted traders to rein in expectations of how quickly the Federal Reserve would be able to cut rates at its September meeting without stoking further inflation.

“What it did was to get rid of all the chat about a 50 basis point cut,” said Mike Houlahan, director at Electus Financial Ltd in Auckland.

The market is currently pricing in a 92.1% probability of a 25 basis point rate cut at its meeting next month, compared with a 100% likelihood of a cut on Thursday, according to the CME Group’s FedWatch tool.

The chance of a jumbo 50 basis point cut fell to zero from an earlier expectation of 5.7% a day ago.

U.S. stock futures were up 0.2% in Asian trading and on track for a fourth day of gains after a choppy trading session on Wall Street on Thursday.

The yield on the U.S. 10-year Treasury bond was down 2 basis points at 4.2732%.

The two-year yield , which is sensitive to traders’ expectations of Fed fund rates, slipped to 3.7233% compared with a U.S. close of 3.739%.

The dollar index , which tracks the greenback against a basket of currencies of other major trading partners, retraced some gains after the PPI data release, last trading down 0.2% at 98.026.

The Nikkei 225 rebounded 1.6% to near a new record high, following a sell-off on Thursday that marked the index’s biggest decline since April 11 and snapped a six-day winning streak.

Japanese GDP data released on Friday showed the economy expanding by an annualised 1.0% in the April-June quarter, beating analyst estimates.

The dollar weakened 0.5% against the yen to 147.09.

Australian shares were last up 0.7%, while stocks in Hong Kong were down 1.1%.

The CSI 300 rose 0.8% after the release of weaker-than-expected Chinese economic data for July including retail sales and industrial production stoked speculation of fresh stimulus.

Markets in India and South Korea are closed for public holidays.

Cryptocurrency markets stabilised after a new record for bitcoin of $124,480.82 on Thursday proved fragile and promptly crumbled after falling short of its next key milestone.

The digital currency was last up 0.8%, recovering some ground, while ether gained 1.7%.

“Bitcoin’s failure to conquer the $125,000 resistance signals another consolidation phase,” said Tony Sycamore, a market analyst at IG in Sydney.

In commodities markets, Brent crude was down 0.3% at $66.63 per barrel ahead of a meeting in Alaska between U.S. President Donald Trump and Russian leader Vladimir Putin.

“The first meeting doesn’t seem like a major market-moving event – it’s more to set up a second meeting, which will likely be more important,” said Marc Velan, head of investments at Lucerne Asset Management in Singapore.

“If a ceasefire is reached, expect a positive reaction in the euro and a weaker dollar; the opposite if a ceasefire fails.”

Gold was slightly lower as the markets digested the path of inflation-adjusted interest rates, which typically move in the opposite direction from bullion prices.

Spot gold was trading up 0.3% at $3,343.94 per ounce.

In early European trades, the pan-region futures were up 0.5%, German DAX futures were up 0.5%, and FTSE futures gained 0.5%.

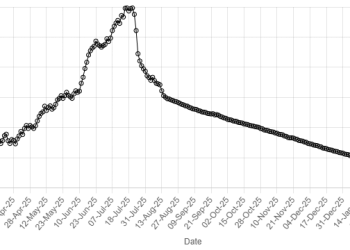

American Dollar Exchange Rate

American Dollar Exchange Rate